EBITDA

EBITDA stands for earnings before interest, taxes, depreciation and amortization. It is worked out by adding taxes, interest expense and depreciation and amortization to net income. It is a measure of standardized operating performance because it excludes the effects of differences in capital structure, taxation and accounting estimates of different companies.

EBITDA excludes the following three crucial expenses for the reasons given below:

- Taxes: Tax expense is determined in accordance with tax accounting rules, which are different than GAAP. Further, different industries have different exposure. Excluding taxes removes the distortion in income that results from differences in tax rules, management’s tax planning, etc.

- Interest Expense: Interest expense is dependent on a company’s capital structure and its choice of debt vs equity capital. For example, a company might keep a very low debt level to keep interest expense low and increase it net income. Excluding interest expense insulates the effect of capital structures.

- Depreciation and Amortization: Depreciation and amortization expenses are effectively a write-off of investment in fixed assets. The depreciation and amortization amounts are greatly affected by the accounting policies (say declining balance method vs straight-line method) and accounting estimates related to useful life, salvage value, etc. Excluding the depreciation and amortization expense removes the differences that arise from difference in management’s accounting policies.

Formula

You can use either of the following formulas to calculate EBITDA depending on the data available:

EBITDA = Net Income + Taxes + Interest Expense + Depreciation + Amortization

EBITDA = Earnings before Interest and Taxes + Depreciation + Amortization

EBITDA = Earnings before Taxes + Interest Expense + Depreciation + Amortization

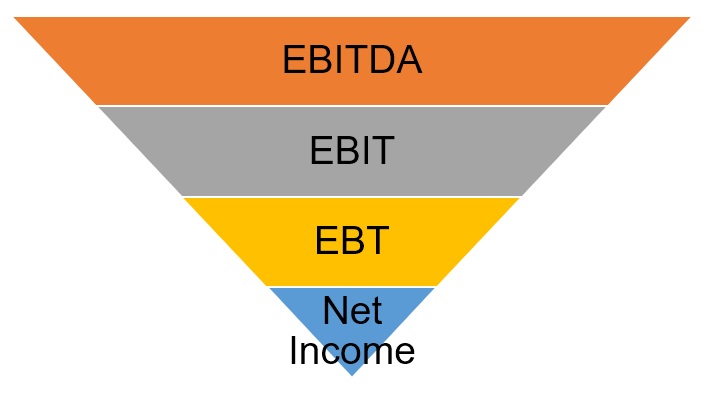

The following chart shows the mutual relationship of EBT, EBIT and EBITDA:

Example

Let’s look at the income statements of the following two companies:

| Income Statement | Company A | Company B |

|---|---|---|

| Revenue | 250,000 | 250,000 |

| Cost of sales | (125,000) | (100,000) |

| Gross profit | 125,000 | 150,000 |

| Operating expense excluding depreciation and amortization | (25,000) | (15,000) |

| EBITDA | 100,000 | 135,000 |

| Depreciation and amortization | (20,000) | (45,000) |

| EBIT | 80,000 | 90,000 |

| Interest expense | (25,000) | (40,000) |

| EBT | 55,000 | 50,000 |

| Tax expense | (16,500) | (12,000) |

| Net income | 38,500 | 38,000 |

| Net profit margin | 15.40% | 15.20% |

Both the companies have almost equal absolute income and net profit margin which may prompt us to complete they have similar financial performance. However, when we dig deeper and remove the effect of relative high depreciation and amortization and interest expense, the picture is quite different.

The following table works out EBITDA for both companies:

| EBITDA calculation | Company A | Company B |

|---|---|---|

| Net income | 38,500 | 38,000 |

| Tax expense | 16,500 | 12,000 |

| Interest expense | 25,000 | 40,000 |

| Depreciation and amortization | 20,000 | 45,000 |

| EBITDA | 100,000 | 135,000 |

| EBITDA margin | 40.00% | 54.00% |

Company B’s operating performance is much better than Company A’s as evident by Company B’s higher EBITDA margin.

This shows that EBITDA is a better indicator of operating profit as it excludes the effect of expenses which are not directly related to the operating decisions in the given year.

Advantages of EBITDA

EBITDA is a very popular measure because of the following strengths:

- It provides a standardized measure of operating earnings insulated from the effect of tax laws, financing decisions and accounting estimates and makes comparisons between companies more meaningful.

- It is easy to work out from the income statement of a company. No external inputs are needed.

- It is an important input in many valuation approaches such as EV/EBITDA.

Weaknesses of EBITDA

Even though EBITDA is useful in many situations, it is not relevant in all instances. The following are its major weaknesses:

- Companies with low net income but high fixed assets and high debt can use it to portray a better picture of its bottom line.

- Even though depreciation and amortization and interest expenses are dependent on capital investments and capital structure, ignoring the capital expenditure and debt outflows altogether tells only a half-truth. Free cash flow is a measure that addresses this critical shortcoming.

- EBITDA is a very poor measure of net cash flows. Even though it adjusts for some non-cash items, it totally ignores the expected capital expenditure, working capital changes and debt related outflows. Free cash flow also addresses this weakness.

by Obaidullah Jan, ACA, CFA and last modified on