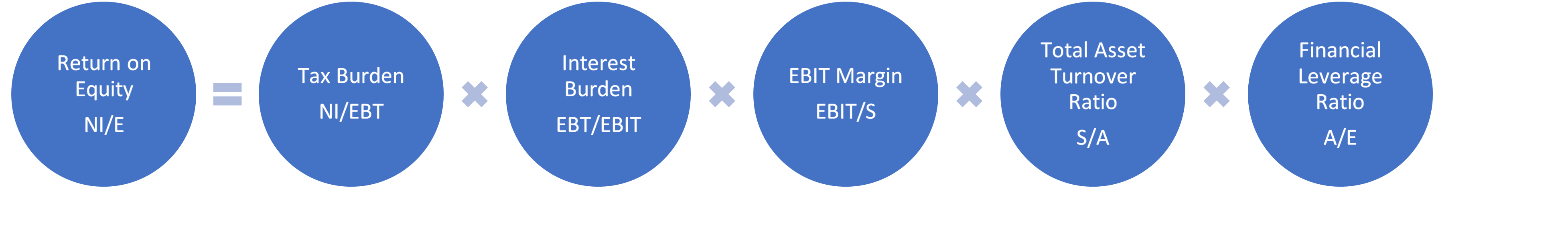

Expanded DuPont ROE Analysis

DuPont decomposition of return on equity (ROE) identifies the drivers of a company’s ROE in terms of EBIT margin, interest burden, tax burden, total asset turnover ratio and financial leverage ratio. In order to achieve high ROE, a company must increase its EBIT margin, decrease its interest expense and taxes, increase its asset utilization and include more debt in its capital structure.

Return of equity equals net income (NI) divided by average shareholders’ equity (E). This can be written as follows:

$$ \text{ROE}=\frac{\text{NI}}{\text{E}} \text{\$\$\$\$} $$

Let’s multiply and divided the right-hand side of the above equation with sales (S), earnings before interest and taxes (EBIT), earnings before taxes (EBT) and average total assets (A):

$$ \text{ROE}=\frac{\text{NI}}{\text{E}}\times\frac{\text{S}}{\text{S}}\times\frac{\text{EBIT}}{\text{EBIT}}\times\frac{\text{EBT}}{\text{EBT}}\times\frac{\text{A}}{\text{A}} $$

By arranging the right-hand side, we get the following equation:

$$ \text{ROE}=\frac{\text{NI}}{\text{EBT}}\times\frac{\text{EBT}}{\text{EBIT}}\times\frac{\text{EBIT}}{\text{S}}\times\frac{\text{S}}{\text{A}}\times\frac{\text{A}}{\text{E}} $$

Tax burden

The first component on the right-hand side of the above equation is the tax burden.

Tax burden in DuPont analysis is the ratio of a company’s net income to its earnings before taxes. It shows the proportion of earnings before taxes (EBT) that’s left after income tax charge.

Tax burden effectively equals 1 minus the tax rate. A high tax burden means that the company is keeping more of its pretax income which will result in higher ROE and vice versa.

Interest burden

The second term is the interest burden.

Interest burden is the ratio of earnings before taxes (EBT) to earnings before interest and taxes (EBIT). It shows the percentage of EBIT left over after deduction of interest expense.

In order to achieve a high ROE, a company must reduce its interest expense such that the EBT/EBIT ratio is high.

EBIT margin

EBIT margin (also called operating margin) is the ratio of earnings before interest and taxes (EBIT) to net revenue. It is a measure of operating performance i.e. profitability without considering the capital structure and tax environment impact.

To achieve a high ROE, EBIT margin must be increased.

Total asset turnover ratio

Total asset turnover ratio is an asset-utilization ratio which measures how efficiently the company is using its total assets to generate revenue.

A high total asset turnover ratio is critical to achieve high ROE. This is because when more dollars of sales are generated per dollar of assets invested, the net profit per dollar of equity increases.

Financial leverage ratio

Financial leverage ratio (also called equity multiplier) is a measure of a company’s capital structure. It equals average assets divided by average shareholders equity.

An increase in debt has magnifying effect on profitability i.e. a high equity multiplier results in high ROE. However, high equity multiplier also means higher interest expense and lower interest burden. Hence, a company must attempt to achieve a good trade-off between debt and equity.

The following graphic shows the return on equity (ROE) components based on the expanded DuPont analysis:

by Obaidullah Jan, ACA, CFA and last modified on