Capital Budgeting Process

The principal objective of a commercial enterprise is to increase their shareholders wealth, which is possible only when a rigorous capital budgeting process is followed in discovering profitable investment opportunities. Net present value and internal rate of return are two of the most popular capital budgeting techniques.

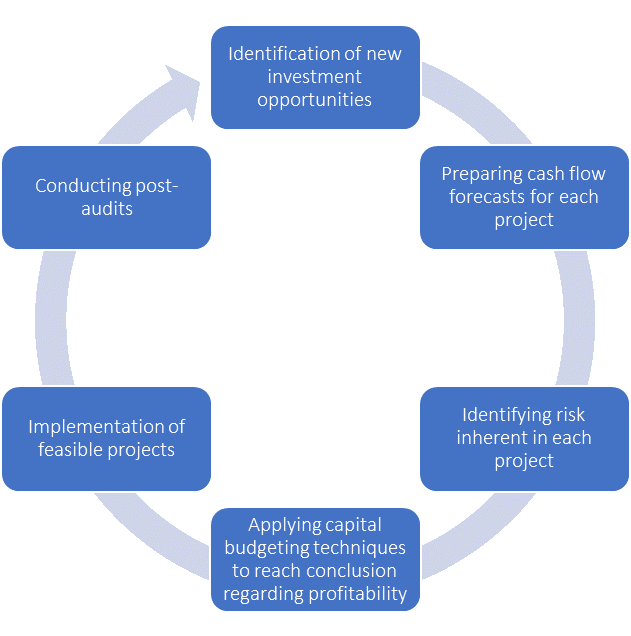

A capital budgeting process involves following stages:

- Identification of new investment opportunities.

- Prepares of cash flow forecasts and estimation of project risk.

- Application of capital budgeting techniques to identify feasible projects.

- Preparation of capital budget.

- Project implementation and post-audit.

Identification of investment opportunities

New investment proposals can come from both lower-level management and senior management.

When investment opportunities are identified by lower-level management, the process is called bottom-up capital budgeting. For example, a plant manager is in a better position to identify whether replacing a machine with its newer version will increase profitability. However, he is not able to identify any synergies possible due to restructuring of different divisions of the company. This is a job of those responsible for strategic management. The process in which senior management make strategic investment choices is called top-down capital budgeting.

Forecasting cash flows and estimating risk

For each investment opportunity, it is important to conduct a numerical analysis of its potential i.e. the absolute value that the project will add to shareholders wealth or the rate of return per dollar invested. The first step in such quantitative analysis is to identify project cash flows.

Project cash flows depend, among other factors, on the overall economic outlook, the company’s competitive strategy and its production capacity. Cash flow projection also depends on broad macroeconomic factors such as GDP growth, inflation rate, unemployment rate, interest rate, etc. and companies formulate detailed expectations about such inputs.

Companies need to guard against over-optimism in preparing their cash flow forecasts. It is important to employ different project risk analysis techniques such as certainty equity cash flows, risk-adjusted discount rate, scenario analysis and sensitivity analysis to correctly reflect project risk.

Application of capital budgeting techniques

Following are the popular capital budgeting techniques used by companies in evaluating projects:

- Net present value (NPV)

- Internal rate of return (IRR)

- Profitability index

- Payback period

- Discounted payback period

- Accounting rate of return

Net present value is an approach which leads us to the right decision in most of the cases. However, many managers prefer internal rate of return (IRR) due to its ability to communicate project profitability in a single number.

Preparation of capital budget

Companies typically have rules dictating the maximum size of a project which can be approved by different management levels. For example, a company might allow plant manager to decide about project requiring initial investment of $1 million but anything above $100 million may require approval of the board of directors.

Once a company has identified all feasible projects, it ranks them through the capital rationing process and create its annual capital budget. A capital budget lists projects which can be financed in a period using available excess cash and equity and debt financing available.

Implementation of projects and their post audits

In the implementation phase of a capital budgeting process, initial investment outlay occurs, and the feasible projects are set in motion.

In the process of post-audit, a company compares actual results i.e. cash flows, cost of capital, taxes, growth rates, etc. with its estimates and assumption and use the insight to change course and improve its future capital budgeting evaluation.

by Obaidullah Jan, ACA, CFA and last modified on