Basic Features and Types of Bonds

Bonds are financial instruments issued by corporations or governments (called the issuer) to investors (called the bondholders) representing the amount of debt due to the bondholders by the issuer.

Bonds are the most popular debt-instruments because they allow issuers to raise debt capital at a cost lower than the bank loans or other forms of debt financing. Each bond issue is governed by a contract called bond indenture which specifies the conditions and lists any covenants that the issuer must meet. Covenants are legal obligations that the bond indenture imposes on the issuer regarding actions it must take and actions it must avoid.

Basic Characteristics

While the terms of different bonds vary a great deal from each other, they all have certain basic features as outlined below:

Par Value

Each bond has a par value (which is also called its face value or principal). It is principal amount at which the coupon payment is calculated. In most cases, it is also the amount which the issuer must pay back to the bond-holder at the maturity date. The par value typically differs from the issue price of the bond because due to a difference between the coupon rate and required rate of return, a bond may sell initially at a discount or premium.

Coupon Interest Rate

Most bonds pay periodic interest payments called coupon bonds. The coupon interest rate (also called the stated interest rate or nominal yield) is the annual percentage rate which is applied to the face value of the bond to calculate coupon payment.

Different bonds have different coupon frequency, the number of coupon payments per year. Further, the coupon interest rate may be fixed or variable i.e. indexed to some underlying interest benchmark such as LIBOR, etc.

Maturity Date

The maturity date of a bond is the date on which the issuer pays back the maturity value of the bond (which is typically equal to the face value) to the bondholder. In most cases, the maturity date is fixed but in some bonds such as callable, putable or convertible bonds, the maturity date is contingent upon occurrence of some event.

The time remaining on a bond till maturity is called tenor.

Maturity Value

The maturity value of the bond is the final cash flow of the bond (which represents the principal) that occurs at the maturity date. It typically equals the face value but can also be different depending on whether the bond has any call or put provision.

Collateral and credit enhancement

Many bond issues are backed by the issuer's assets or financial guarantees from third parties. Further, different bond issues have different ranking when it comes to their entitlement to receive liquidation proceeds if the issuer defaults.

Bond Yield

Bond yield is the discount rate at which the present value of bond cash flows equals the market price of the bond. Some measures of bond yield include current yield, yield to maturity, yield to call, etc.

Types of bonds

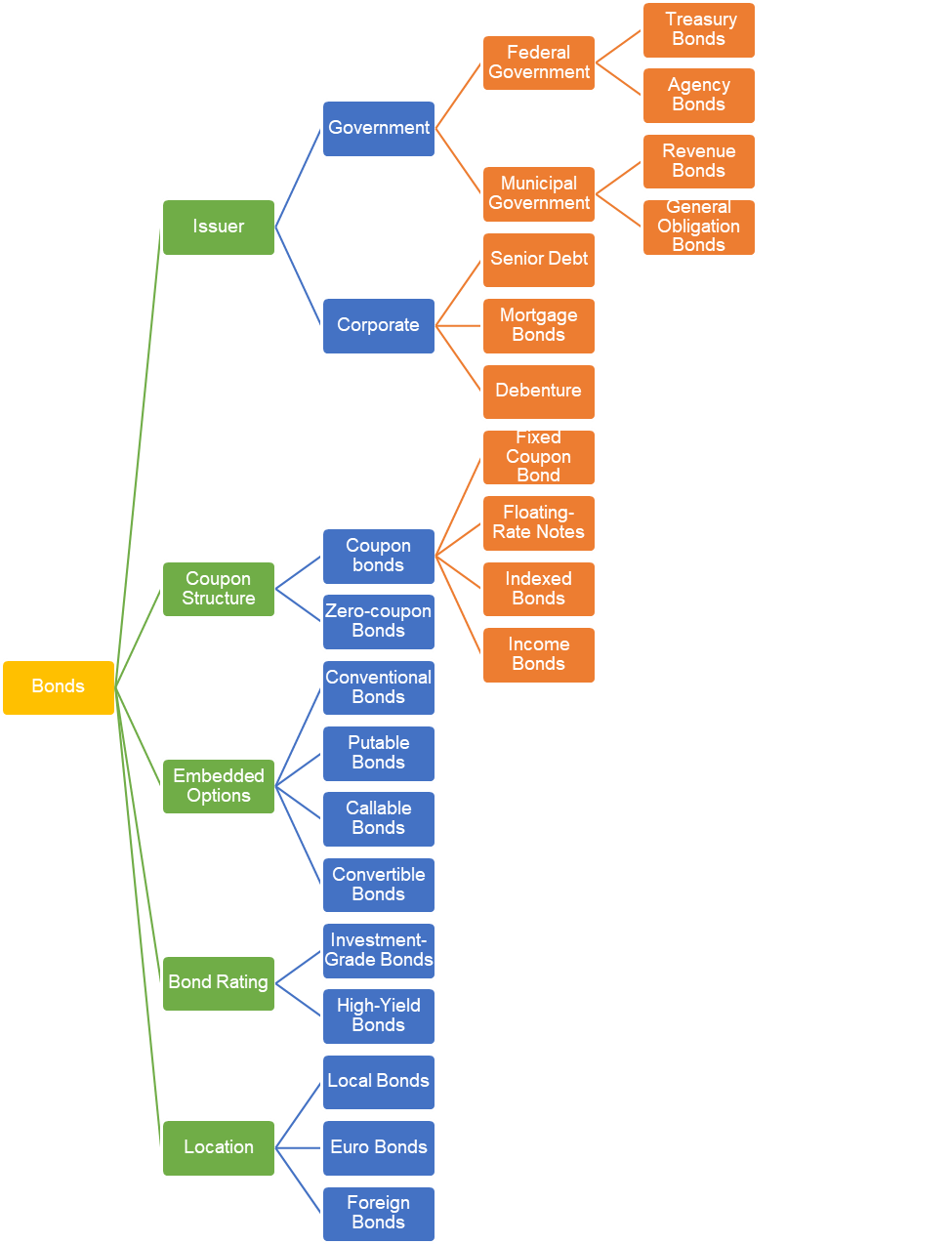

Bonds are classified into different types depending on primarily on their issuer, coupon payment structure, existence of any embedded options and their bond rating, etc.

Government bonds

Governments bonds are bonds issued by a federal (foreign or local) government.

Federal government bonds

US government bonds are called treasury notes (when the maturity is more than one year but less than ten) and treasury bonds (when the maturity is more than 10 years). Despite the difference in terminology, they are both bonds. US treasury securities (T-bill, treasury notes and treasury bonds) are theoretically risk-free. UK government bonds are called gilts.

Municipal bonds

Where the bonds are issued by a state or local government, they are called municipal bonds (or munis for short).

Revenue bonds

They are typically issued to finance an infrastructure project and the interest is paid out of the revenue of the project, in which case they are called revenue bonds.

General-obligation bonds

All municipal bonds other than the revenue bonds are called general-obligation bonds because the state’s obligation to pay back the loan is general and not limited to revenue of any project.

Corporate bonds

Corporate bonds are bonds issued by corporations. Their issue is regulated by the relevant corporate regulator such as the Securities & Exchange Commission in US. Corporations typically issue a document (called prospectus) outlining the purpose of the issue and offering an overview of its business and the issue is managed by investment bankers.

Mortgage bonds

Typically, corporations offer an asset such a plant or inventories as a collateral to be liquidated to pay back the bondholders in case of default by the issuer), in which case the bonds are called mortgage bonds.

Debentures

Where no collateral is offered against a bond, it is called a debenture.

Bonds classification based on embedded options

Standard bonds have a fixed maturity date but some bonds, called callable bonds, give the issuer the option to retire the bonds prior to maturity date; and some bonds, called putable bonds, give the bondholder the option to redeem their bonds prior to maturity. Convertible bonds are bonds that can be converted to the common stock of the corportion issuing them at the option of the bondholder.

Bond types based on coupon structure

Zero-coupon bonds

While a standard bond pays periodic interest, there are bonds that do no pay any periodic coupon payments instead all their return comes from the difference in their initial issue price and final redemption value at maturity. Such bonds are called zero-coupon bonds (also called discount bonds or deep discount bonds).

Floating-rate bonds

While most bonds have a fixed coupon rate, some bonds, called floating-rate bonds, have a coupon-rate linked to some other reference rate such a LIBOR.

Indexed bonds

Coupon payments on some bonds, called inflation-protected bonds, is linked to some measure of inflation such as CPI such that the bondholder is protected against inflation. Treasury bonds that are indexed to inflation are called treasury-inflation protected securities (or TIPS).

Investment-grade bonds vs junk bonds

Rating agencies such as Standard & Poor’s, Moody’s and Fitch rate government and corporate bonds which are indicative of the bond’s default risk. Bonds with a rating of BBB- or Baa3 are called investment-grade bonds and bonds that have a rating lower than BB or Ba are called junk bonds (also called high-yield bonds) because they have an elevated risk of default and hence higher yields.

by Obaidullah Jan, ACA, CFA and last modified on