Net Operating Cycle

Net operating cycle measures the number of days a company’s cash is tied up in inventories and receivables on average. It equals days inventories outstanding plus days sales outstanding minus days payable outstanding. It is also called cash conversion cycle.

An operating cycle starts with purchase of raw material typically on credit. The number of days in which a company pay back its creditors is called days payable outstanding. The raw materials are processed and converted to finished goods which are sold to customers. It is rarely the case that finished goods are sold to customers right away. Instead, companies are required to maintain a stock of inventories. The number of days it takes a company to sell the inventories is called days inventories outstanding. Inventories are predominantly sold on credit which means the company must wait a certain number of days till it receives cash from customers. The time it takes in collecting receivables on average is called the days sales outstanding.

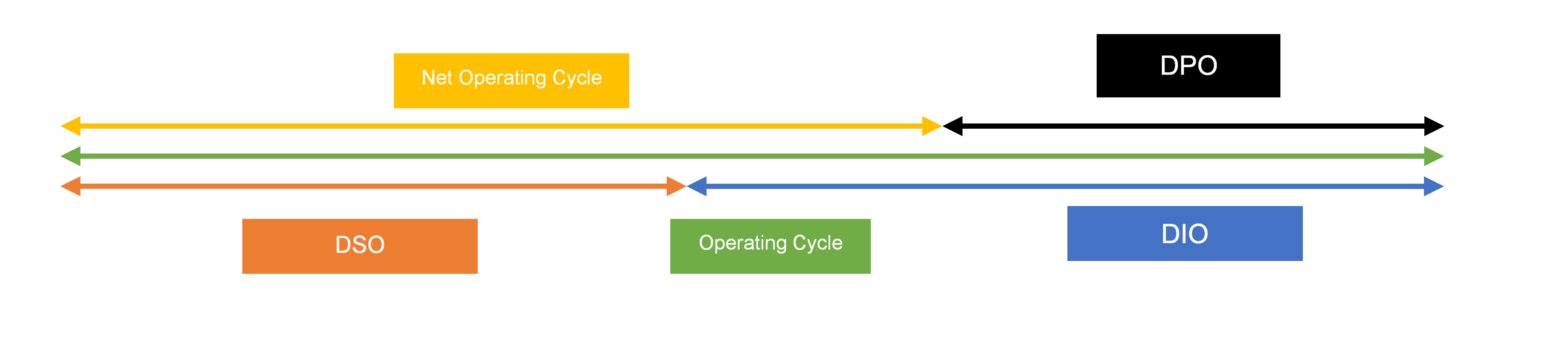

Net operating cycle vs operating cycle

The number of days it takes a company in selling inventories and collecting cash from customers is called the operating cycle. But because a company has obtained inventories on credit itself, the net number of days its cash is tied up is actually lower by the days payables outstanding. The following chart illustrates the relationship:

Formula

The following formula can be used to calculate net operating cycle:

$$ \text{Net Operating Cycle}=\text{DIO}+\text{DSO}-\text{DPO} $$

Where DIO is the days sales in inventories, DSO is the days sales in inventories and DPO is the days payable outstanding representing the number of days it takes the company to sell inventories, receive collections from receivables and pay creditors respectively.

The following formulas can be used to work out DIO, DSO and DPO

$$ \text{DIO}=\frac{\text{D}}{\text{Inventory Turnover Ratio}}=\frac{\text{365}}{\text{COGS}/\text{Average Inventories}} $$

$$ \text{DSO}=\frac{\text{D}}{\text{Receivables Turnover Ratio}}=\frac{\text{365}}{\text{Revenue}/\text{Average Receivables}} $$

$$ \text{DIO}=\frac{\text{D}}{\text{Payables Turnover Ratio}}=\frac{\text{365}}{\text{Purchases}/\text{Average Payables}} $$

Where D is the number of days for which the relevant turnover ratios are available i.e. 365 in case of a year.

Example

Following is an extract from HP financial statements for FY 2017.

Calculate net operating cycle given the following data:

| USD in million | 2016 | 2017 |

|---|---|---|

| Receivables | 4,114 | 4,414 |

| Inventories | 4,484 | 5,786 |

| Accounts payable | 11,103 | 13,279 |

Revenue for FY 2017 is $52,056 million and cost of revenue is $42,478 million respectively. Assume 75% of the cost of revenue represent purchases of raw materials.

The following table calculate the constituent days outstanding ratios i.e. DIO, DSO and DPO:

| Component | Calculation | DIO | DSO | DPO |

|---|---|---|---|---|

| Number of days | D | 365 | 365 | 365 |

| Revenue | 52,056 | |||

| Cost of revenue | 42,478 | |||

| Purchases | 31,859 | |||

| Average balance | 5,135 | 4,264 | 12,191 | |

| Turnover ratios | T | 10.14 | 9.96 | 2.61 |

| Relevant days outstanding ratios | D/T | 36.00 | 36.64 | 139.67 |

The net operating cycle can be calculated as follows:

$$ \text{Net Operating Cycle}=\text{36}+\text{36.64}-\text{139.67}=-\text{67.03} $$

The company has a negative net operating cycle which shows that the company is effectively using the money of its creditors as working capital. It took the company 36 days on average to sell its inventories and 36.64 days to receive cash from its customers i.e. distributors, etc. but it delayed the payment to its suppliers till the 140th day. While it is a good for the company’s shareholders that the company is keeping its working capital low, they need to make sure that the very long days payable outstanding is not due to any liquidity problem.

by Obaidullah Jan, ACA, CFA and last modified on