Simple Interest vs Compound Interest

Interest is the income earned or expense incurred on a loan or other investment that pays a fixed profit. There are two variants of interest: simple interest and compound interest. In simple interest, interest is accumulated only on the principal amount but in compound interest, interest is accumulated on both the principal and any interest earned previously.

Simple Interest

In simple interest, there is no interest on interest. The future value (FV) of an investment that adds interest only on principal equals the present value (PV) plus total interest accrued:

This can be expressed mathematically as follows:

Future Value

= Present Value + Simple Interest

Interest accrued under the simple interest method equals the product of present value (PV), periodic interest rate i and number of time periods t:

Simples Interest

= PV × i × t

The time period of i and t must match. For example, if i is for a quarter, t must be expressed in quarters.

FV = PV + PV × i × t

FV = PV × (1 + i × t)

Alternatively, simple interest can be calculated using the INTRATE function in Excel.

Compound Interest

Compound interest is where interest for a period is worked out based on the loan or investment value at the beginning of the period inclusive of the interest accumulated to that date.

Let’s you have an investment with principal value PV and annual compound interest rate r, the value of investment after first year will be PV × (1 + r), after second year it will be PV × (1 + r) × (1 + r), after third year, it will be PV × (1 + r) × (1 + r) × (1 + r) and so on. We can derive the following formula to calculate future value of a single sum under the compound interest:

FV = PV × (1 + r)n

Where there are more than one compounding periods per year, the above formula can be modified as follows:

FV = PV × (1 + r/m)n × m

Where r is the annual percentage rate, n is the number of years and m is the number of compounding periods per year.

Interest earned between two periods under the compound interest equals the future value minus the initial principal amount.

Compound interest can also be calculated using the Microsoft Excel RATE function

Example

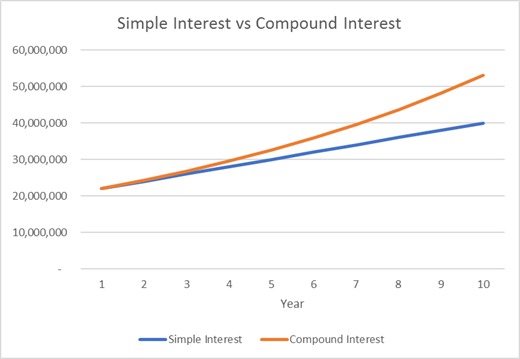

The Wadiyan dictator Haffaz Aladeen allows its banks to charge only simple interest. Your company has raised $20 million worth of loan from one Wadiyan Bank at 10% per annum and invested the proceeds at 10% interest compounded twice a year. Find out your outstanding loan balance and investment value at the end of 10th year.

Loan Balance

= $20,000,000 × (1 + 0.1 × 10)

= $40,000,000

Investment Value

= $20,000,000 × (1 + 0.1/2)10 × 2

= $53,065,954

The difference between the investment value and loan balance of $13,065,954 is attributable to interest on interest. This difference between total interest earned or incurred increases with increase in interest rate i, compounding periods per year m and total number of years n.

The following chart visualizes the difference between the loan balance under simple interest and investment value under compound interest over time.

by Obaidullah Jan, ACA, CFA and last modified on