Types of Interest Rates

An interest rate is a percentage which represents the cost of money as a percentage of initial principal. Interest rates differ depending on whether they are nominal or real, quoted or effective, annual or periodic and so on.

An interest rate differs from a discount rate in that the interest rate is calculated with reference to the present value (i.e. initial value of principal) while a discount rate is calculated with reference to the maturity value (the future value).

For example, consider a financial instrument of maturity value of $1,000 due in 1 year which is currently priced at $900. The absolute cost of money (i.e. the total interest amount) in this transaction is $100 (=$1,000 - $900). If this instrument is based on discount, the discount rate is calculated by dividing the total interest amount by the final maturity value ($1,000) and the interest rate is calculated by dividing the total interest amount by the initial principal value ($900)

$$ \text{Interest Rate}=\frac{\text{\$1,000}\ -\ \text{\$900}}{\text{\$900}}=\text{11.11%} $$

$$ \text{Discount Rate}=\frac{\text{\$1,000}\ -\ \text{\$900}}{\text{\$1,000}}=\text{10.00%} $$

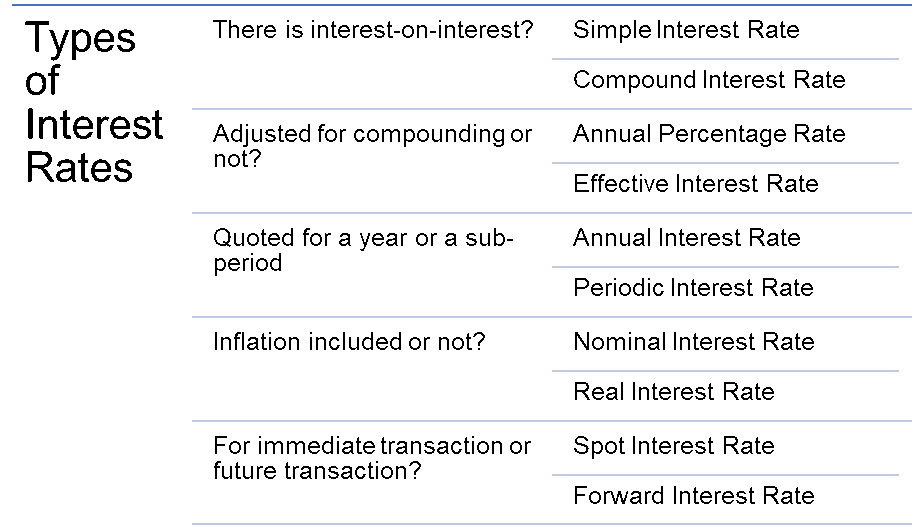

The following diagram shows different classifications of interest rates:

Simple vs Compound Interest Rate

A simple interest rate is the interest rate in a transaction in which interest accrues only on the principal balance and not on any interest previously accrued. On the other hand, a compound interest rate is the interest rate that applies when interest is earned on both the principal and any interest previously accrued.

For example, if you lend $1,000 on a simple interest of 10%, the simple interest that accrues in both the first and the second years would be $100 (=$1,000×10%). However, if it is a compound interest, the interest in second period is $100 (=($1,000 + 1,000×10%)×10%). The compound interest rate is calculated by first adding the interest earned in previous periods to the principal.

Annual vs Effective Interest Rate

The annual percentage rate (also called nominal interest rate or quoted interest rate) is the interest rate which does not take into account the effect of multiple compounding periods per year. On the other hand, the effective interest rate (also called effective annual rate (EAR)) is an interest rate which includes the accelerating effect of multiple compounding periods.

The annual percentage rate is converted to periodic interest rate by dividing it with the number of compounding periods per year (m):

$$ \text{Periodic Interest Rate}=\frac{\text{Annual Percentage Rate}}{\text{m}} $$

An annual percentage rate can be converted to effective interest rate using the following equation:

$$ \text{Effective Interest Rate}=\left(\text{1}+\frac{\text{APR}}{\text{m}}\right)^\text{m}-\text{1} $$

Where APR is the annual percentage rate and m is the number of compounding periods per year.

The effective interest rate is always higher than the annual percentage rate when there are more than one compounding periods per year.

Nominal vs Real Interest Rate

A nominal interest rate is not adjusted for inflation i.e. it includes the effect of inflation, but the real interest rate excludes inflation and measures only the real increase in wealth of the lender.

The relationship between the nominal interest rate (rn), real interest rate (rr) and inflation rate (i) is given by the Fisher equation:

$$ \text{r} _ \text{n}=(\text{1}+\text{r} _ \text{r})(\text{1}+\text{i})-\text{1} $$

An approximation can be obtained using the following simpler equation:

$$ \text{r} _ \text{n}=\text{r} _ \text{r}+\text{i} $$

Spot vs Forward Interest Rate

A spot interest rate is an interest rate which applies to an immediate transaction while a forward interest rate is the interest rate today that applies to a transaction on some future date.

Forward interest rates can be worked out using spot rates for two different maturities. For example, if S1 is the annual spot rate for a 2 years and S3 is the annual spot rate for 3 years, the forward interest rate (f) that applies to a loan/investment that initiates at the end of 2nd year and terminates at the end of 3rd year can be obtained using the following equation:

$$ \text{f}=\frac{{(\text{1}+\text{S} _ \text{3})}^\text{3}}{{(\text{1}+\text{S} _ \text{2})}^\text{2}}-\text{1} $$

by Obaidullah Jan, ACA, CFA and last modified on