Treasury Inflation Protected Securities

Treasury inflation protected securities (TIPS) are bonds issued by US Treasury whose principal balance changes with a change in the Consumer Price Index which in turn also changes their periodic coupon payment on the bonds.

At the maturity date, TIPS holders receive the adjusted principal balance (i.e. the face value of the bond adjusted for all the changes in consumer price index, whether positive or negative, during the life of the bond) or the original principal balance whichever is higher.

Just like the conventional Treasury bonds, they pay interest semiannually and they have zero credit risk because they are backed by the US Federal Government. However, unlike the conventional bonds, TIPS do not have inflation risk and they typically offer lower yield.

TIPS have original maturity of 5, 10 and 30 years.

Adjustment Formula

The coupon payment on a TIPS can be worked out using the following formula:

| Coupont = Ft-1 × | 1 + | CPIt | × | c | ||

| CPIt-1 | 2 |

Where Coupont is the semi-annual coupon amount for coupon period t, Ft-1 is the face value of the TIPS at the start of the coupon period t, CPIt and CPIt-1 are the consumer price index values for period t and t-1 respectivley, and c is the annual coupon rate.

US Treaury publishes TIPS Inflation Index Ratios which can also be used to work out inflation adjustment for any TIPS currently outstanding.

Example

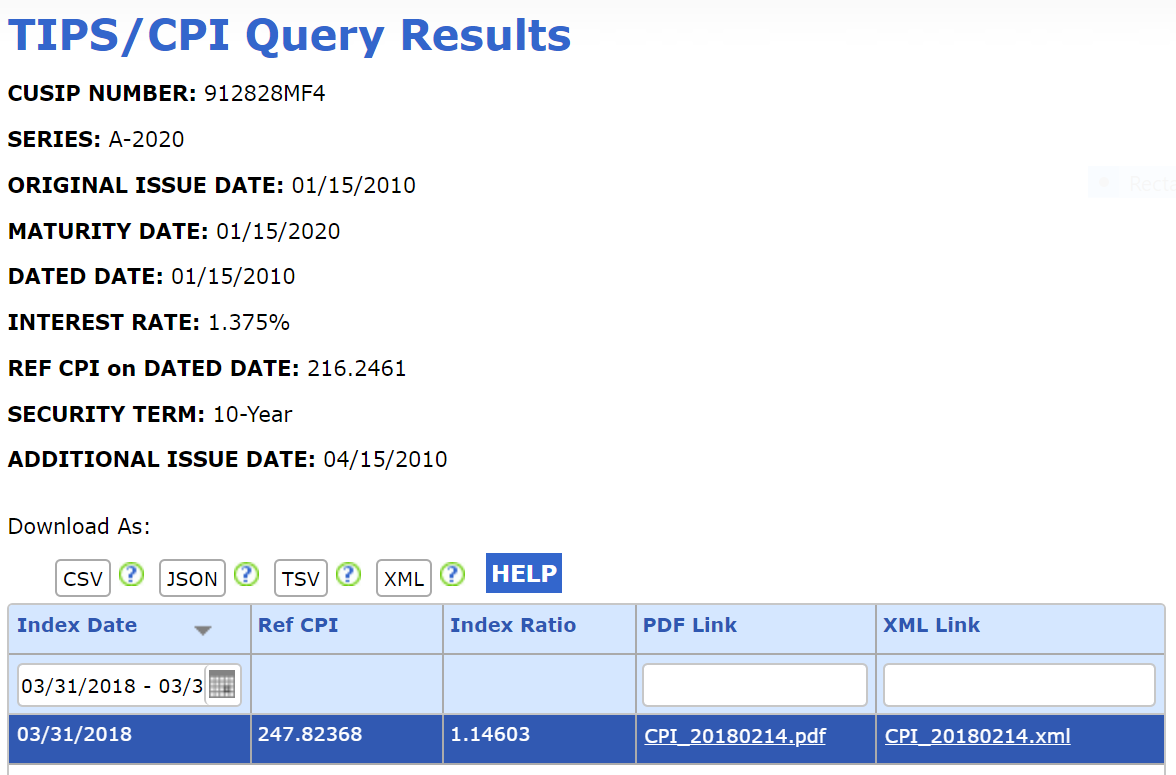

The following information is obtained from TreasuryDirect website:

| CUSIP Number | 912828MF4 |

|---|---|

| Series | A-2020 |

| Original Issue Date | 01/15/2010 |

| Maturity Date | 01/15/2020 |

| Dated Date | 01/15/2010 |

| Interest Rate | 1.375% |

| Reference CPI on Dated Date | 216.2461 |

| Security Term | 10-Year |

| Additional Issue Date | 04/15/2010 |

The CPI values as at 31 March 2018 is 247.82368, so the principal balance of the TIPS can be worked out as follows:

Adjusted Principal

= $100 × 247.82368/216.2461

= $114.6026

The TIPS Inflation Index Ratio corresponding to this bond issue as at 31 March 2018 is 1.14603 which can also be used to work out the TIPS new principal value:

Adjusted Principal

= $100 × 1.14603

= $114.603

The accrued interest on the bond since the last coupon rate till 31 March 2018 can be worked out as the product of the adjusted principal balance and annual interest rate and actual number of days between 31 March 2018 and last coupon rate divided by total number of days in a year.

You can invest in TIPS by buying TIPS directly from Treasury or even better you may invest in TIPS ETFs.

While TIPS can be a worthwhile investment, following two factors must be kept in mind:

- They might have lower yield than conventional Treasury bonds i.e. elimination of inflation risk comes at a cost.

- When CPI drops, the adjusted principal balance may fall resulting in a decrease in coupon payment.

- Any increase in principal is taxable in the period in which it occurs which may eat up any inflation protection offered.

by Obaidullah Jan, ACA, CFA and last modified on