Excel DB Function

DB is an Excel function that calculates the depreciation expense in a period under the declining balance method. Declining balance method is an accelerated depreciation method, a method in which the depreciation expense is highest in initial year and declines over time.

In declining balance method, depreciation expense for first period is calculated by applying the depreciation rate to the cost of the asset. In subsequent periods, depreciation rate is applied to the opening book value (also called carrying value) of the asset.

Under the variable declining balance method, depreciation rate to be applied to the opening carrying balance of an asset is worked out using the following formula:

$$ \text{Declining Balance Depreciation Rate}=\text{1}-\sqrt[\text{n}]{\frac{\text{Salvange Value}}{\text{Cost}}} $$

DB is an Excel function that calculate the depreciation charge in any period directly using the variable declining balance method.

Syntax

DB’s syntax is:

DB(cost, salvage, life, period, [month])

Where cost is the total cost of the asset, salvage is the amount at which we expect to sell the asset once its is totally used up (it is also called residual value or scrap value), life is the total number of periods for which we expect the asset to be useful, period refers to the chronological number of the period for which we want to calculate depreciation expense and [month] is an optional argument to specify the number of months in first year. If omitted its default value is 12.

Unit of time used for life argument and period argument must be consistent, i.e. years in both or months in both and DB returns result in the same time unit.

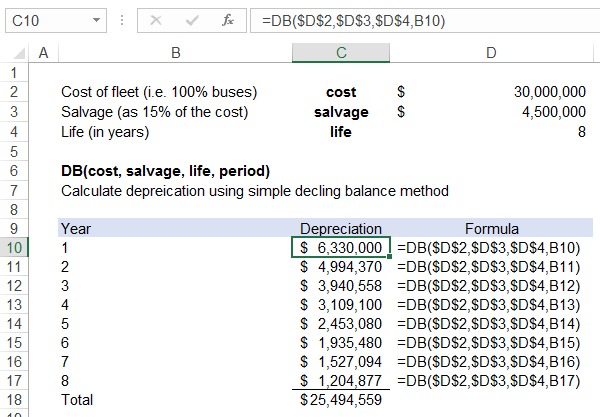

Depreciation expense under the declining balance method declines over time as you can see from the screenshot below:

As you can see, the total depreciation expense charged over the eight years i.e. $25,494,559 doesn't exactly match the depreciable amount of $25,500,000. The difference of $5,441 is due to the variable nature of Excel DB function. If we calculate depreciation on month-basis instead of years, the difference will shrink. For example, if you want to get a more accurate depreciation expense for Year 2, you should recreate the depreciation schedule by calculating monthly depreciation for 96 months and then summing depreciation expense from Month 13 to Month 24 to get a more accurate value for Year 2 depreciation expense.

by Obaidullah Jan, ACA, CFA and last modified on