Excel DDB Function

DDB is an Excel function that calculates the depreciation expense on an asset under the double declining balance. DDB stands for double declining balance, a magnified form of accelerated depreciation method.

The first period depreciation expense under the double-declining balance method equals the cost divided by life multiplied by the magnification [factor]. Depreciation expense in subsequent periods equals the opening carrying value of the asset divided by the remaining useful life multiplied by the magnification [factor].

Syntax

DDB function’s syntax is:

DDB(cost, salvage, life, period, [factor])

Cost refers to the cost of the asset, salvage is the value of the asset at the end of its useful life (also called residual value or scrap value). Period represent the number of period for which we want to determine the depreciation expense. [factor] is an optional argument which species the extent of accelerated depreciation, the default value is 200%, which means depreciation expense in a period is twice the expense under the single declining balance method.

Even though the DDB function calculates 200%-declining balance depreciation by default, we can use it to calculate depreciation expense under a different magnification [factor].

Example

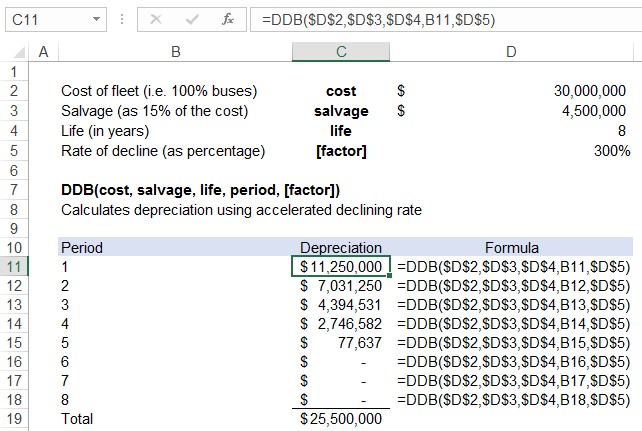

Let's say you company purchased a fleet of buses for $30 million. Their salvage value is $4.5 million and useful life of each bus is 8 years.

Depreciation expense under the 300%-declining balance method can be calculated manually as follows:

$$ \text{300%\ Declining Balance Depreciation}\ (\text{Year 1}) \\ =\text{\$30,000,000}\times\frac{\text{1}}{\text{8}}\times\text{0.3} \\ =\text{\$11,250,000} $$

$$ \text{Carrying Value at Start of Year 2} \\ =\ \text{\$30,000,000}\ -\ \text{\$11,250,000} \\ =\ \text{\$18,750,000} $$

$$ \text{300%\ Declining Balance Depreciation}\ (\text{Year 2}) \\ =\text{\$18,750,000}\times\frac{\text{1}}{\text{8}}\times\text{0.3} \\ =\text{\$7,031,250} $$

Alternatively, we can use Excel DDB function

Under the 300%-declining balance method, you can see that depreciation expense is so accelerated that asset is fully depreciated by the start of 5th year. However, please note that Excel has not depreciated the fleet to a value lower than its salvage value.

by Obaidullah Jan, ACA, CFA and last modified on