Depreciation

Depreciation is the process through which the cost of a tangible asset i.e. property, plant and equipment is charged as an expense on income statement. Popular depreciation methods include straight-line method, declining balance method, units of production method and MACRS.

Amount expended on purchase of fixed assets is a capital expenditure i.e. it is expected to generate revenues and/or cost savings over a period of more than one year. A capital expenditure is recorded as an asset on balance sheet and a portion of it is transferred to income statement each period reflecting the use of the asset in the operations of the business. The amount at which the asset is recorded on a balance sheet is called its cost and it is a measure of the present value of total economic benefits which the asset holds.

When an asset is used, its usefulness decreases due to wear and tear, obsolescence, etc. Hence, it makes sense to reduce the cost of the asset through depreciation to reflect the drop in productivity of the asset. The depreciation process reduces the cost of the asset by the amount of depreciation expense each period. When an asset gets older, its productivity declines till it reaches a point when it is no longer feasible to continue using the asset. Most assets still have some value even at the end of their useful life, for example third parties might be interested in purchasing it so they can overhaul or refurbish it and use it their own operations or the asset can also be sold just to recover the recyclable material, etc. The amount at which a fixed asset can be disposed off at the end of its useful life is called salvage value (or residual value or scrap value).

Because some portion of an asset’s cost is recoverable in the form of salvage value, not all of the cost is written off as depreciation. The cost of an asset which shall be charged to income statement as depreciation in all periods of its useful life is called its depreciable amount (also called depreciable cost) and it equals the historical cost minus the salvage value.

Depreciation expense is the amount subtracted from revenue each period on account of the use of the fixed asset. The total depreciation expense charged on an asset since its acquisition is called accumulated depreciation.

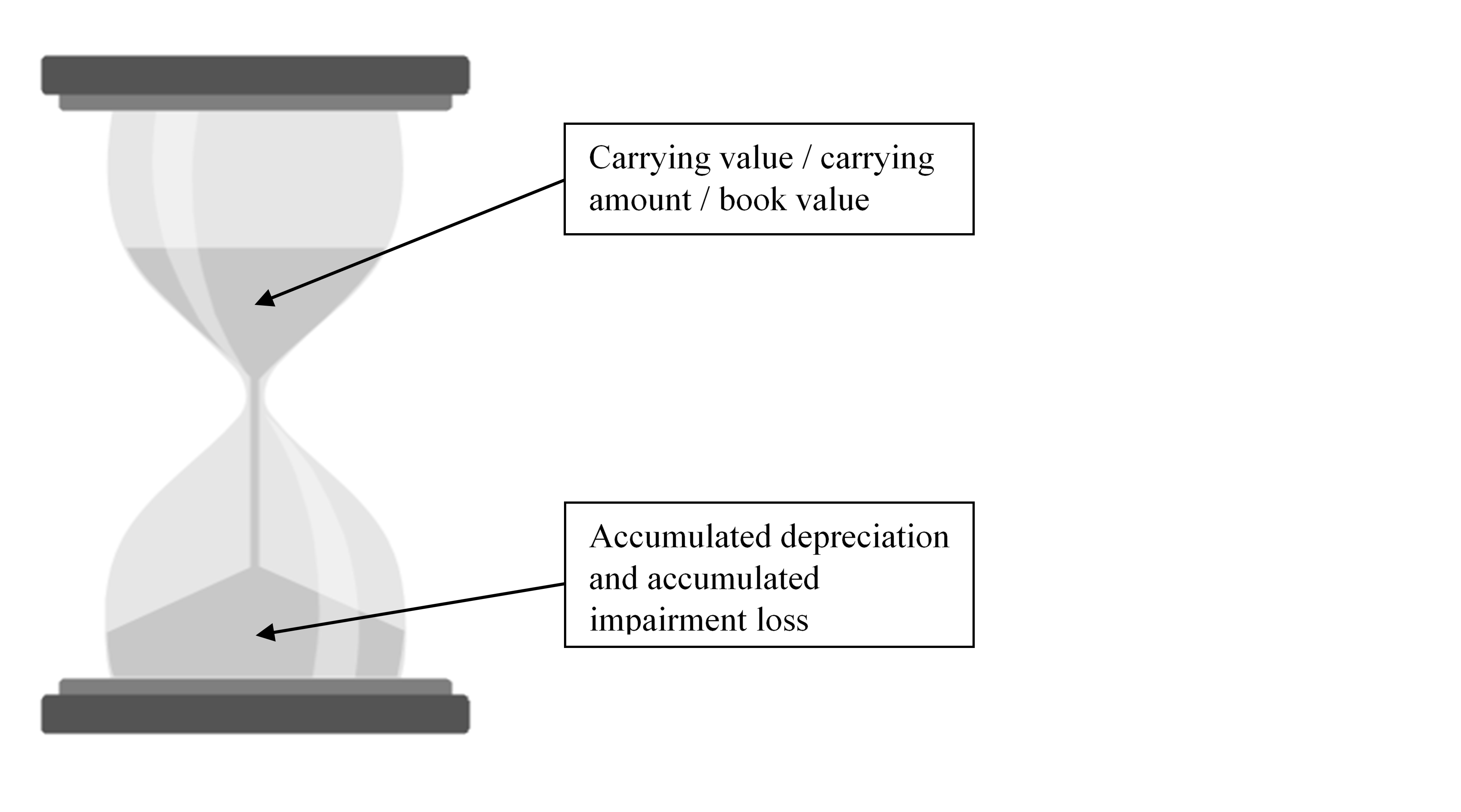

Each asset is an hour glass and depreciation is the flow of time which reduces the amount of sand in the upper half (represented by the carrying value) and increases the amount of sand in lower half (which is equivalent to accumulated depreciation).

Popular depreciation methods include the straight-line method, declining balance method, units of production method. Under the straight-line method, equal depreciation expense is charged in each period of the asset’s useful life but in the declining balance method, higher depreciation expense is charged in earlier periods. The units of production depreciation method charges depreciation based on the actual usage of the asset. The total depreciation expense charged over the life of the asset is the same regardless of the method used. The different depreciation methods differ just in the inter-period allocation of cost. The depreciation method selected must correspond to the manner in which the asset is expected to be used. If the asset is expected to be more productive in earlier years, the declining balance method is appropriate.

by Obaidullah Jan, ACA, CFA and last modified on