Excel SLN Function

SLN is an Excel function that calculates the depreciation expense to be charged on an asset under the straight-line depreciation method. . As the name suggest, straight-line method charges depreciation equally over the useful life of the asset.

Straight-line depreciation method is one of the most common depreciation method because it is the most straight-forward.

Depreciation expense for each period can be calculated manually using the following formula:

$$ \text{Straight line method depreciation expense}=\frac{\text{cost}-\text{salvage value}}{\text{useful life}} $$

Alternatively, we can calculate depreciation expense using SLN function is an Excel function.

Syntax

SLN function syntax is:

SLN(cost, salvage, life)

Cost represents the dollar amount of initial capitalized cost of the asset being depreciated.

Salvage represents the dollar amount of scrap value, i.e. the value that can be realized from the asset after it is completely depreciated. Cost minus salvage value equals depreciable amount. This value is important because no asset is depreciated down to a value less than its salvage value.

Life is the total number of periods for which we expect to use the asset. SLN function returns depreciation expense for the same time unit in which we enter life.

Example

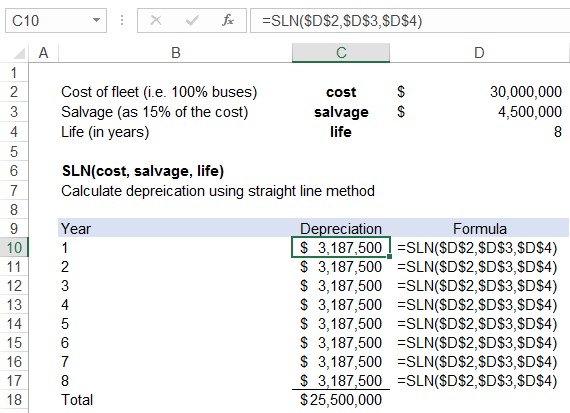

The following chart illustrate use of SLN function for an asset with a cost of $30 million, salvage value (also called residual value or scrap value) of $4.5 million and useful life of 8 years:

As you can see, depreciation expense is constant for each period i.e. it follows a straight-line if graphed; hence, the name. Please note that life is entered in years because we are calculating depreciation expense for yearly period.

by Obaidullah Jan, ACA, CFA and last modified on