Cost Classifications

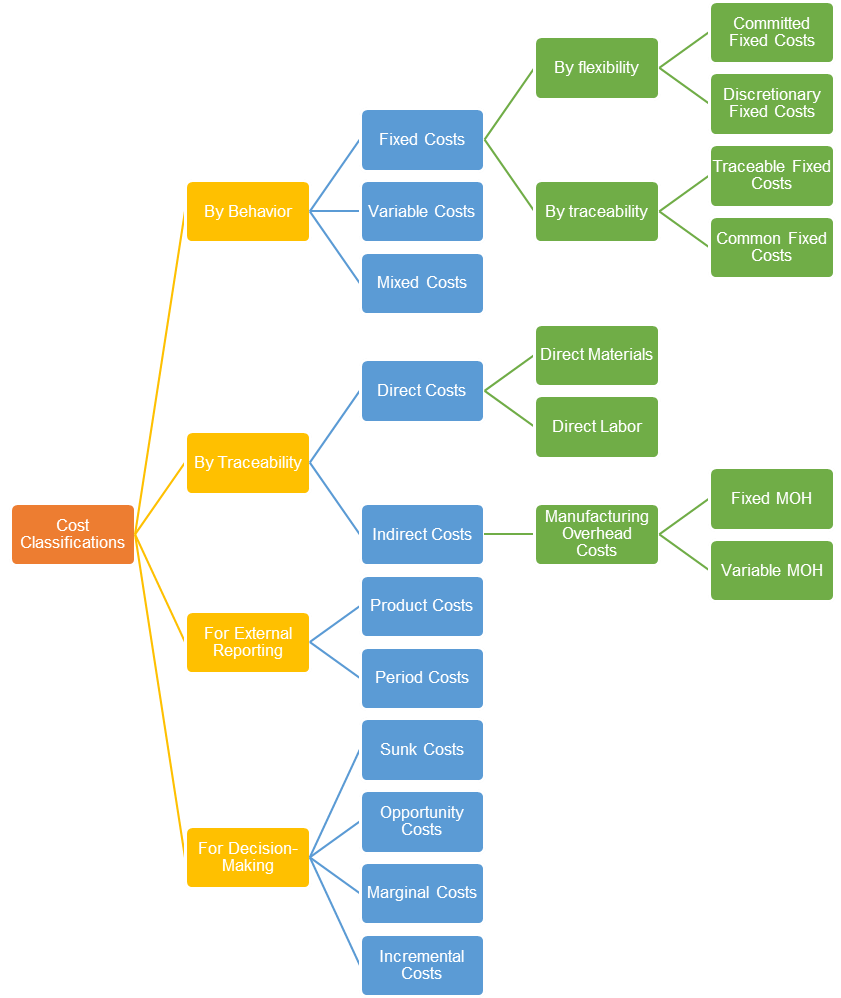

In managerial accounting, costs are classified into fixed costs, variable costs or mixed costs (based on behavior); product costs or period costs (for external reporting); direct costs or indirect costs (based on traceability); and sunk costs, opportunity costs or incremental costs (for decision-making).

Classification of costs based on behavior helps in cost-volume-profit analysis. Classification based on traceability is important for accurate costing of jobs and units produced. Classification for the purpose of decision-making is important to help management identify costs which are relevant for a decision.

Cost Classification Diagram

The following diagram summarizes the different categories into which costs are classified for different purposes:

Product Costs vs Period Costs

Product costs (also called inventoriable costs) are costs assigned to the manufacture of products and recognized for financial reporting when sold. They include direct materials, direct labor, factory wages, factory depreciation, etc.

Period costs are on the other hand are all costs other than product costs. They include marketing costs and administrative costs, etc.

Breakup of Product Costs

The product costs are further classified into direct materials, direct labor and manufacuturing overhead costs:

- Direct materials: Represents the cost of the materials that can be identified directly with the product at reasonable cost. For example, cost of paper in newspaper printing, etc.

- Direct labor: Represents the cost of the labor time spent on that product, for example cost of the time spent by a petroleum engineer on an oil rig, etc.

- Manufacturing overhead costs: Represents all production costs except those for direct labor and direct materials, for example the cost of an accountant's time in an organization, depreciation on equipment, electricity, fuel, etc.

Direct Costs vs Indirect Costs

The product costs that can be specifically identified with each unit of a product are called direct product costs. Whereas those which cannot be traced to a specific unit are indirect product costs. Thus direct material cost and direct labor cost are direct product costs whereas manufacturing overhead cost is indirect product cost.

Prime Costs vs Conversion Costs

Prime costs are the sum of all direct costs such as direct materials, direct labor and any other direct costs.

Conversion costs are all costs incurred to convert the raw materials to finished products and they equal the sum of direct labor, other direct costs (other than materials) and manufacturing overheads.

Fixed Costs vs Variable Costs

Fixed costs are costs which remain constant within a certain level of output or sales. This certain limit where fixed costs remain constant regardless of the level of activity is called relevant range. For example, depreciation on fixed assets, etc.

Variable costs are costs which change with a change in the level of activity. Examples include direct materials, direct labor, etc.

Mixed costs (also called semi-variable costs) are costs which have both a fixed and a variable component.

Sunk Costs vs Opportunity Costs

The costs discussed so far are historical costs which means they have been incurred in past and cannot be avoided by our current decisions. Relevant in this regard is another cost classification, called sunk costs. Sunk costs are those costs that have been irreversibly incurred or committed; they may also be termed unrecoverable costs.

In contrast to sunk costs are opportunity costs which are costs of a potential benefit foregone. For example the opportunity cost of going on a picnic is the money that you would have earned in that time.

by Obaidullah Jan, ACA, CFA and last modified on