Business Combinations

A business combination is an event which results in one company, called the acquirer, obtaining control over one or more businesses, called the acquiree(s). US GAAP and IFRS require business combinations to be accounted for under the acquisition method.

Control is presumed when a company acquires a majority of outstanding voting shares of the acquiree. However, it is not a rule as circumstances in which a minority shareholder holds control are not rare.

A business combination may occur through a transfer of either cash and cash equivalents and other assets or equity instruments of the acquirer to the acquiree, incurring of liabilities or even through a contract.

There are different ways in which a business combination may be structured. For example, the acquiree may become a subsidiary of the acquirer thereby continuing as a separate legal entity, or the net assets of the acquiree may be merged with those of the acquirer (and the acquiree entity dissolved), and so on.

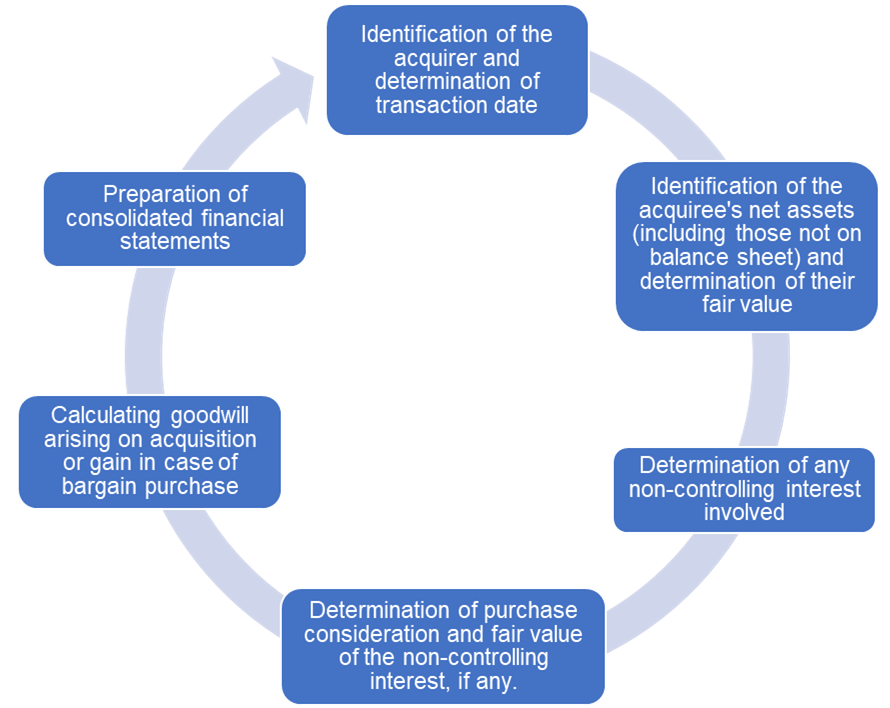

Accounting for a business combination

Business combinations are accounted for under the acquisition method which involves combining assets and liabilities of the acquiree with the acquirer and recognizing any goodwill. Since the operating and financing decisions of the target are controlled by the acquirer after the business combination, it is useful to treat both the companies as a single company and prepare their consolidated financial statements.

The following cycle shows the steps involved:

Example

Company P’s management has agreed with the Board of Directors of Company S to acquire 75 million shares of Company S by issuing 40 million of its own shares plus $500 million in cash. The negotiations began on 1 April 20X1 and were finalized on 1 July 20X1.

Total outstanding shares of common stock of Company S are 100 million which are currently priced at $20 per share. The fair value of Company P stock is $50.

Extracts from the statement of financial position of Company S on the acquisition date is given below. All amounts are expressed in US$ in millions.

| Total non-current assets | 3,200 |

| Total current assets | 1,600 |

| Total assets | 4,800 |

| Total shareholders equity | 1,200 |

| Non-current liabilities | 2,500 |

| Total current liabilities | 1,100 |

| Total shareholders equity and liabilities | 4,800 |

The fair values of the assets and liabilities are the same as their book values except for the following:

- If revalued, PPE would increase by $200 million.

- Receivables require recognition of impairment losses of $20 million.

- Current liabilities must be increased by $30 million.

Further, intangible assets worth $500 million do not appear in Company S’s financial statements because the applicable accounting standards did not allow their recognition.

Solution

We first need to determine the acquisition date. It is the date on which consideration is transferred and business is acquired. In this example, it is the date the deal is finalized i.e. 1 July 20X1.

Purchase consideration equals the fair value of assets transferred.

Purchase consideration = Fair value of shares issued + Cash transferred

Purchase consideration = $50 × 40 million + $500 million = $2,500 million

The non-controlling interest is measured at its fair value as follows:

Fair value of non-controlling interest = (100 million - 75 million) × $20 = $500 million

The fair value of net identifiable assets is calculated as follows:

| Carrying amount of net assets on the acquiree’s balance sheet | 1,200 |

| Add: Recognition of intangible asset | 500 |

| Add: Upward revaluation of PPE | 200 |

| Less: Impairment on receivables | (20) |

| Less: Increase in current liabilities | (30) |

| Fair value of net identifiable assets | 1,850 |

Now that we have figured out the fair value of net assets, NCI and purchase consideration, we can determine the goodwill.

Goodwill = Purchase consideration + Fair value of NCI - Fair value of net assets

Goodwill = $2,500 million + $500 million - $1,850 million = $1,150 million

The value of non-controlling interest would equal the NCI share in the net identifiable assets plus NCI share of goodwill. Alternatively, at acquisition date, it equals the fair value of NCI.

NCI = NCI share in FV of net assets + NCI share in goodwill

NCI = 25% × $1,850 million + ($500 million - 25% × $1,850 million) = $500 million

The following journal entry shows the adjustments needed:

| Non-current assets (3,200 + 200 + 500) | 3,900 | |

| Current assets (1,600 - 20) | 1,580 | |

| Goodwill | 1,150 | |

| Non-current liabilities | 2,500 | |

| Current liabilities (1,100 + 30) | 1,130 | |

| Cash | 500 | |

| Common stock | 2,000 | |

| Non-controlling interest | 500 |

by Obaidullah Jan, ACA, CFA and last modified on