Price Floor

A price floor is a minimum price enforced in a market by a government or self-imposed by a group. It tends to create a market surplus because the quantity supplied at the price floor is higher than the quantity demanded.

Demand curve is generally downward sloping which means that the quantity demanded increase when the price decreases and vice versa. Similarly, a typical supply curve is upward sloping i.e. quantity supplied increases with increase in price and vice versa. Market activity converges the quantity demanded and quantity supplied and the price at which it happens is called the market-clearing price (or equilibrium price).

A price floor doesn’t let the market clearing price fall below an arbitrary reference point. The interplay of demand and supply happens as long as the market price is higher than the reference point but as soon as price hits the floor, it doesn't fall any further. When a market reaches a price floor, it results in an excess supply because quantity supplied at the price floor exceeds the quantity demanded.

Examples

Important examples include (a) minimum wage, (b) agricultural price supports and (c) price agreements reached by an oligopoly.

Let’s consider the example of market for unskilled labor. Governments impose minimum wage for unskilled labor which is set at subsistence level. No employer can hire a worker for a wage less than the minimum wage. As of 24 July 2009, the minimum wage in United States is $7.25 per hour.

Similarly, governments impose price floors in agriculture in order to convince farmers to keep farming certain critical crops like wheat, sugar cane, etc. They fear that lack of a guaranteed price might reduce the supply of the commodity drastically because farmers might switch to other crops.

Graph and Analysis

The actual impact of a price floor on the market depends on two factors: (a) whether the equilibrium price is lower than the price floor and (b) relative elasticity of demand to supply.

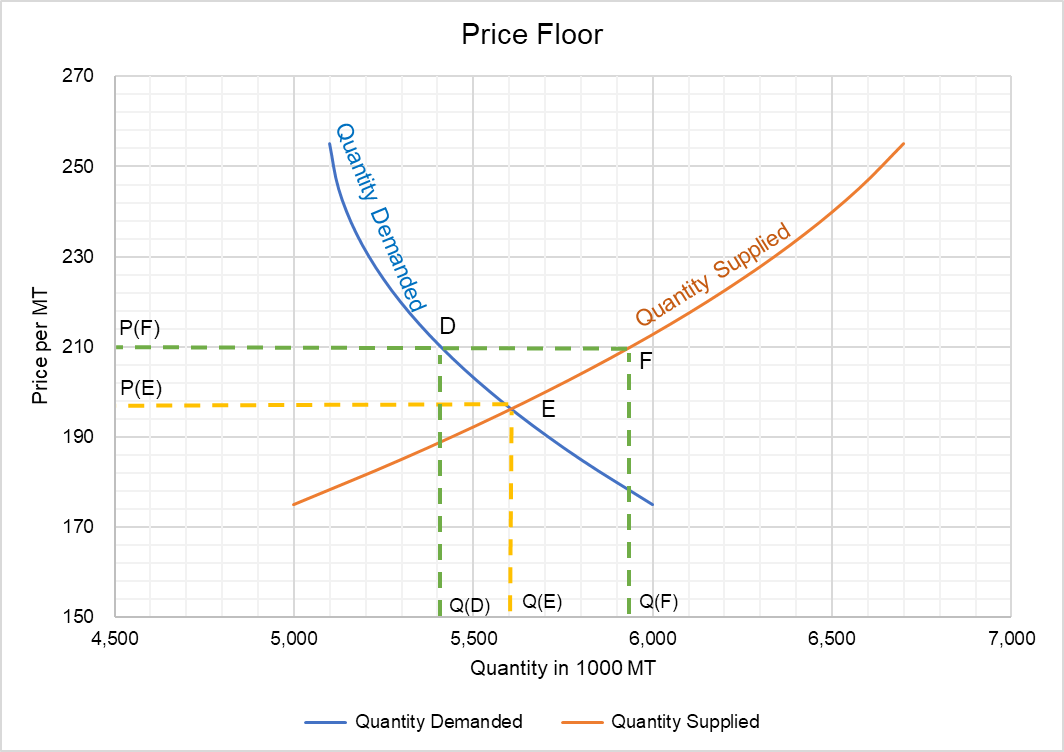

Let’s consider the market for wheat in a developing country. The government has imposed a minimum price of $210 per metric ton of wheat. The following chart plot the demand curve and supply curve for wheat.

Since the equilibrium price P(E) is below the minimum price P(F) i.e. $210, the price floor is going to affect the market.

At price $210 per metric ton, farmers are happy to produce quantity Q(F) but the consumers demand only Q(D). This will result in excess supply which equals Q(F) minus Q(D). This is why price floors are generally considered inefficient.

by Obaidullah Jan, ACA, CFA and last modified on