Goodwill Calculation

Goodwill arising in a business acquisition equals the excess of the sum of fair value of purchase consideration and fair value of non-controlling interest over the fair value of net identifiable assets of the subsidiary.

Goodwill represents the value of a company in excess of the fair value of its known net assets. It is the additional amount that an investor is willing to pay to acquire the company as a whole over the sum of amounts it is willing to pay for individual assets net of its liabilities.

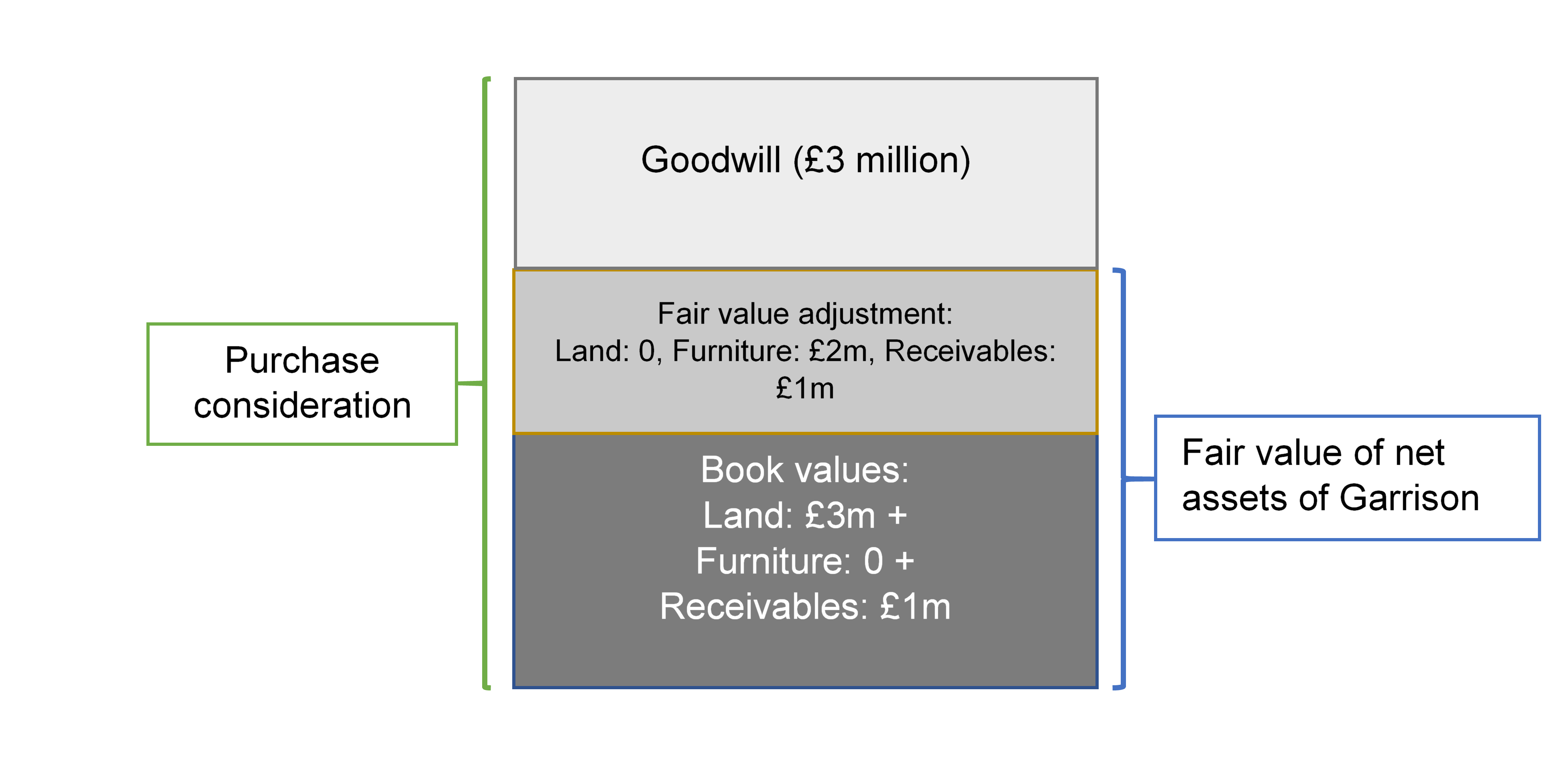

Let’s say Thomas Shelby Limited (TS) offered to acquire Garrison Limited, a pub owner, for £10 million. The value of the property is £3 million (the same as its book value), the replacement cost of the furniture and fittings is £2 million (and the carrying amount is 0), receivables amount to £2 million (but they are carried at £1 million in the books due to bad debts). However, with Thomas Shelby’s backing, the whole £2 million is recoverable.

The fair value of net identifiable assets of Garrison is £7 million (£3 million + £2 million + £2 million). Since the purchase consideration paid is higher, the differential i.e. £3 million (£10 million - £7 million) is attributable to goodwill.

Goodwill allocation

When the parent does not acquire all of the subsidiary’s outstanding common stock, some portion of the subsidiary’s ownership rests with outside investors called minority (non-controlling) shareholders. The stake of outside investors in a subsidiary is called non-controlling interest (also called minority interest).

When non-controlling interest (NCI) exists, the goodwill arising on acquisition must be allocated between the parent and the NCI. The allocation depends on whether the fair value of purchase consideration and fair value non-controlling interest at the acquisition date were based on the same price per share of the common stock. If the fair value of purchase consideration (paid by the parent) and fair value of the non-controlling interest are based on the same share price, goodwill is allocated proportionately. However, where the majority stake is valued at a relatively higher price (i.e. the price paid per share by the parent is higher than the price paid by minority shareholders) due to existence of control premium, the allocation of goodwill is not proportionate. Where control premium exists, the additional goodwill resulting from premium is allocated solely to the parent and the amount of goodwill allocated to subsidiary is the same as if no control premium existed.

Example

TS acquires 7.5 million shares of common stock of Camden Town Ltd. (CT) representing a 75% stake. The remaining 25% belongs to the non-controlling interest. The fair value of net identifiable assets of CT is £80 million. Work out how goodwill must be allocated between TS and NCI if (a) both the parent’s stake and the NCI are valued at £9 per share (a) the parent’s stake is valued at £11 per share and the NCI is valued at £9.

In case of (a) above, both the parent’s stake and the non-controlling interest are valued at the same price per share, hence, there is no control premium, the following table shows the goodwill allocation:

| Scenario (a) | Parent | NCI | Total |

|---|---|---|---|

| Fair value of consideration | 67,500,000 | 22,500,000 | 90,000,000 |

| Proportionate fair value of net identifiable assets | 60,000,000 | 20,000,000 | 80,000,000 |

| Goodwill | 7,500,000 | 2,500,000 | 10,000,000 |

| Percentage | 75% | 25% | 100% |

In case (b), the allocation is different as shown in the schedule below:

| Scenario (b) | Parent | NCI | Total |

|---|---|---|---|

| Fair value of consideration | 82,500,000 | 22,500,000 | 105,000,000 |

| Proportionate fair value of net identifiable assets | 60,000,000 | 20,000,000 | 80,000,000 |

| Goodwill | 22,500,000 | 2,500,000 | 25,000,000 |

| Percentage | 90% | 10% | 100% |

by Obaidullah Jan, ACA, CFA and last modified on