Consolidation Worksheet

Consolidation worksheet is a tool used to prepare consolidated financial statements of a parent and its subsidiaries. It shows the individual book values of both companies, the necessary adjustments and eliminations and the final consolidated values.

A business combination takes the form of either a statutory merger or a statutory consolidation. In a statutory merger, the acquiree (the target) dissolves and the acquirer (the parent) absorbs it. Because such a business combination leads to a single combined entity, the accounting records of the acquirer and acquiree are permanently consolidated. In a statutory consolidation or acquisition, however, the acquirer and acquiree continue in existence as separate legal entities and the consolidation process is carried out afresh whenever consolidated financial statements are required. Consolidation worksheet helps in the simulation consolidation required at each reporting date.

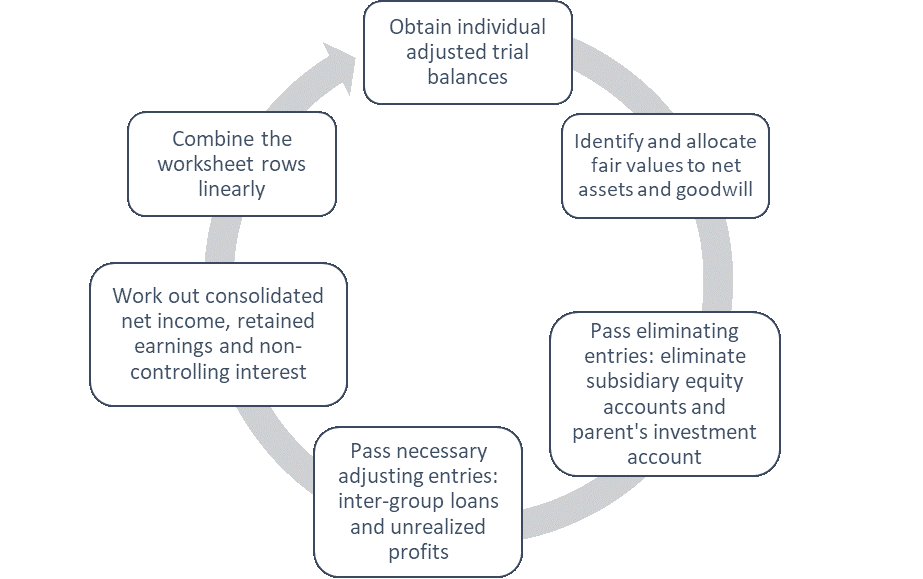

Consolidation process

The consolidation process has the following steps:

- Step 1: obtain the individual financial statement of the parent and the subsidiary;

- Step 2: identify the fair value of consideration transferred and the fair value of net assets of the subsidiary and work out if there is any goodwill; pass consolidation entries to bring the subsidiary book values to their fair values with a corresponding effect in the investment in subsidiary account;

- Step 3: eliminate the equity accounts (i.e. common stock, additional paid-up capital and retained earnings) and the investment in subsidiary account as it appears in the individual financial statements of the parent

- Step 4: adjust for any group transactions such as loans made and unrealized gains in inventories sold between the parent and the subsidiary;

- Step 5: find out consolidated net income; net income attributable to non-controlling interest and use it to work out consolidated retained earnings and non-controlling interest;

- Step 6: combine the individual book values of assets and liabilities and equity accounts, associated eliminating and adjusting entries to find out consolidated balance sheet accounts.

Example

Company A acquired 100% of Company B by paying $50 million. The fair value of net assets of the Company B at the time of acquisition was $40 million. The book values of Company B’s assets and liabilities were the same in case of Company B except for non-current assets whose fair value exceeded book value by $5 million.

The following is a very basic acquisition-date consolidated worksheet:

| USD in million | Company A | Company B | Total | Dr | Cr | Consolidated |

|---|---|---|---|---|---|---|

| Income Statement | ||||||

| Revenues | 1,000 | 1,000 | 1,000 | |||

| Expenses | 800 | 800 | 800 | |||

| Net income | 200 | 200 | 200 | |||

| Statement of Equity | - | |||||

| Opening equity | 220 | 220 | 220 | |||

| Net income | 200 | 200 | 200 | |||

| Dividends | (30) | (30) | (30) | |||

| Closing equity | 390 | 390 | 390 | |||

| Balance sheet | ||||||

| Assets | ||||||

| Goodwill | - | - | - | 5 | 5 | |

| Investment in Company B | 50 | - | 50 | 50 | - | |

| Other non-current assets | 540 | 80 | 620 | 5 | 625 | |

| Current assets | 250 | 40 | 290 | 290 | ||

| Total assets | 840 | 120 | 960 | 920 | ||

| Non-current liabilities | 150 | 40 | 190 | 190 | ||

| Current liabilities | 50 | 40 | 90 | 90 | ||

| Shareholder's equity | - | |||||

| Common stock | 100 | 10 | 110 | 10 | 100 | |

| Additional paid-up capital | 150 | 20 | 170 | 20 | 150 | |

| Retained earnings | 390 | 10 | 400 | 10 | 390 | |

| Total liabilities and equity | 840 | 120 | 960 | 920 |

In this particular case, consideration transferred is $50 million and the fair value of net assets of Company B is $45 million (book value of net assets of $40 million plus $5 million fair value upward adjustment to non-current assets). Hence, goodwill is $5 million (=$50 million - $45 million).

The following entry is needed in the consolidation worksheet to eliminate the investment in Company B account, adjust non-current assets upwards by $5 million and eliminate company B equity accounts:

| Account | Dr | Cr |

|---|---|---|

| Goodwill | $5 million | |

| Non-current assets | $5 million | |

| Company B common stock | $10 million | |

| Company B additional paid-up capital | $20 million | |

| Company B retained earnings | $10 million | |

| Investment in Company B (in books of Company A) | $50 million |

The above worksheet is created at the acquisition date. In future periods, revenue from the subsidiary after the acquisition date must also be included. Additional complexity arises in consolidation process when (a) the subsidiary is not 100% owned and/or (b) there are transactions between the group companies.

by Obaidullah Jan, ACA, CFA and last modified on