Purchase Price Allocation

Purchase price allocation is the process through which purchase consideration paid in a business combination is allocated between the assets of the acquiree and goodwill, if any.

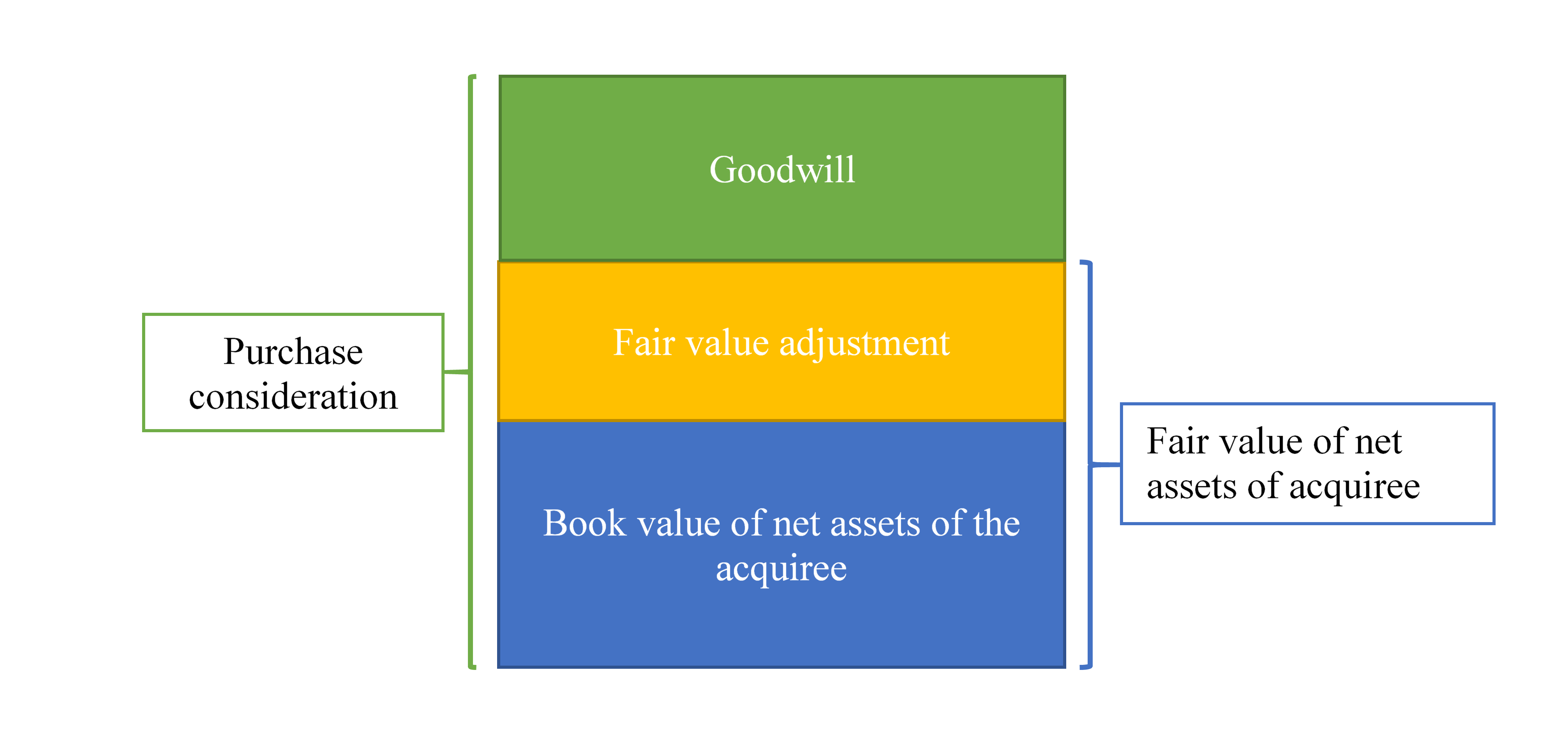

A business combination is a transaction in which the acquirer transfers cash or its own stock to the acquiree or its shareholders in return of the acquiree’s net assets or its stock. The consideration (cash or stock) transferred to the acquiree is called purchase consideration. The purchase consideration differs from the book value of the net assets acquired and its fair value as illustrated by the following chart:

The fair value of purchase consideration differs form book value of net assets due to two reasons: First, the book values are based on historical cost in most cases but in a business combination, an acquirer assess them at their fair value. This is represented by the difference represented by the yellow-shaded area. Second, even fair values of net assets do not capture the whole value of a company, for example, accounting standards do not allow companies to recognize many internally-generated intangible assets. Then there is the value which comes from a company's brand name, reputation, culture, management quality, etc. But a potential acquirer must compensate the target company's investors for this undocumented value to convince them to sell their stake in the company. This second component is called goodwill. These components can be negative.

Purchase price allocation is all about identifying assets and liabilities of the acquiree, correctly assigning fair values to each identifiable asset and identifying whether there is a goodwill or bargain purchase. One important consideration is to identify intangible assets which are not recognized in the acquiree’s business, but which nonetheless exist due to contractual and legal rights.

Example

Company A has offered $250 million to purchase 100% stake in Company B. Following are the book values and the fair values of the acquiree’s assets and liabilities:

| USD in million | Book Value | Fair Value |

|---|---|---|

| Property, plant and equipment | 220 | 250 |

| Investments | 80 | 80 |

| Inventories | 40 | 40 |

| Accounts receivable | 30 | 25 |

| Other current assets | 10 | 10 |

| Long-term debt | 150 | 140 |

| Current liabilities | 40 | 40 |

There exists an intangible asset worth $12 million which are not recognized by Company B in its books.

Following is the allocation schedule which shows how the purchase consideration is allocated between different assets and goodwill:

| Fair value of (purchase) consideration transferred | C | 250 |

| Book value of net assets | B | 190 |

| Total differential | D = C - B | 60 |

| Intangible asset recognized | I | 12 |

| Fair value adjustment | F | 35 |

| Total asset recognition and fair value adjustment | T = I + F | 47 |

| Goodwill | G = D - T | 13 |

The book value of net assets equals the excess of book value of total assets over book value of total liabilities and the fair value adjustment equals the difference between fair value of net assets and their book values as shown below:

| USD in million | Book Value | Fair Value | Increase in Fair Value |

|---|---|---|---|

| Property, plant and equipment | 220 | 250 | 30 |

| Investments | 80 | 80 | - |

| Inventories | 40 | 40 | - |

| Accounts receivable | 30 | 25 | (5) |

| Other current assets | 10 | 10 | - |

| Long-term debt | (150) | (140) | 10 |

| Current liabilities | (40) | (40) | - |

| Net | 190 | 225 | 35 |

The purchase consideration allocation is recognized through a journal entry when the acquiree ceases to exist as a separate entity, otherwise this journal entry is used in the consolidation worksheet to simulate business combination.

by Obaidullah Jan, ACA, CFA and last modified on