Non-controlling Interest

Non-controlling interest (NCI) is a component of shareholders equity as reported on a consolidated balance sheet which represents the ownership interest of shareholders other than the parent of the subsidiary. Non-controlling interest is also called minority interest.

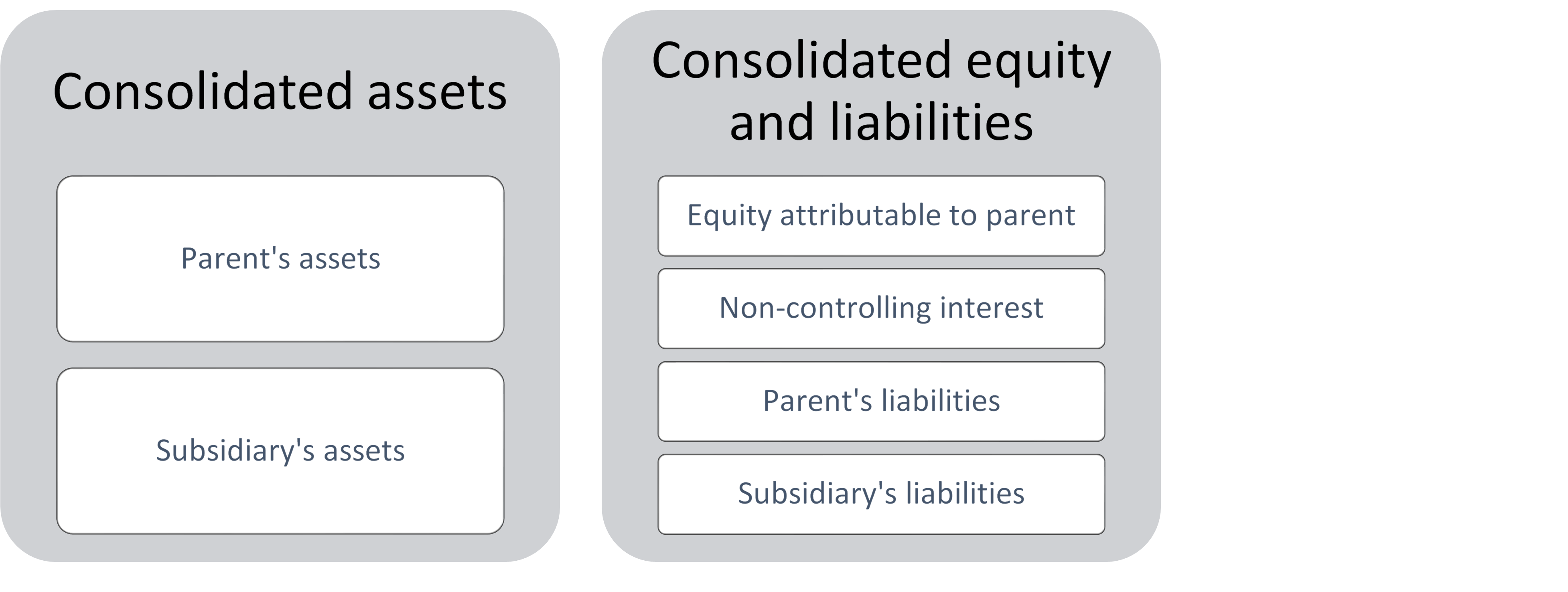

Non-controlling interest arises in business combination in which the parent acquires less than 100% of the subsidiary. Acquisition method requires the parent to present consolidated financial statements i.e. financial statements which combine total assets and liabilities of the parents with total assets and liabilities of the subsidiary. But because not all assets and liabilities belong to the parent, the shareholders equity section is bifurcated into net assets that belong to the parent and net assets that belong to the other minority shareholders as illustrated by the chart below:

When a company acquires another company, it compares sum the fair value of purchase consideration it pays plus the fair value of the non-controlling interest with the fair value of net identifiable asset of the subsidiary to arrive at goodwill or any bargain purchase.

Formula

Non-controlling interest on balance sheet equals the proportionate share of the non-controlling shareholders in the fair value of the net assets of subsidiary at the acquisition date plus the proportionate share of non-controlling shareholders in retained earnings since acquisition less their proportionate share in dividends.

| NCI in fair value of subsidiary’s net assets at acquisition date | P × FV |

| Add: NCI share in opening retained earnings | P × RE |

| Less: cumulative proportionate amortization of fair value differential | P × FVD |

| Add: net income attributable to NCI | P × SI |

| Less: dividends paid to non-controlling shareholders | P × D |

| Non-controlling interest at the date of consolidation | NCI |

Alternatively, it can be calculated by starting with proportionate share of the subsidiary’s net asset at the start of the consolidation period plus any unamortized fair value adjustments plus net income attributable to non-controlling shareholders during the period less their proportionate share of dividends.

| NCI share of opening net assets of subsidiary | P × NA |

| Add: NCI share of unamortized fair value differential | P × FVD |

| Add: net income attributable to NCI | P × SI |

| Less: dividends paid to non-controlling shareholders | P × D |

| Non-controlling interest at the date of consolidation | NCI |

Where P is the proportionate ownership of minority shareholders. FV is the fair value of net identifiable assets of the subsidiary at acquisition date, RE is opening retained earnings of the subsidiary, FVD is the accumulated amortization of fair value differential, UFVD is the unamortized fair value differential, SI is subsidiary income, NA is the book value of net assets at the start of the consolidation period, D is total dividends declared during the period.

Example

Let’s consider a very simple example. Company A acquired 75% stake in Company B for $50 million when the fair value and book value of net assets of Company B were $40 million and $35 million respectively. The non-controlling interest at acquisition date is $10 million (=25% of $40 million). It can be calculated as the sum of proportionate share in net assets i.e. $8.75 million (=25% of $35 million) plus proportionate share in net fair value differential i.e. $1.25 million (=25% of $5 million).

During the first year of acquisition, Company B earned net income of $8 million, but no dividends are paid. If the fair value differential is amortized over 5 years equally, the value of non-controlling interest at the end of first year since acquisition can be worked out as follows:

| NCI in fair value of subsidiary’s net assets at acquisition date | 25% × $40 million |

| Add: NCI share in opening retained earnings since acquisition | 25% × 0 |

| Less: NCI share of any cumulative fair value amortization | 25% × $10 million × 1/10 |

| Add: net income attributable to NCI | 25% × $8 million |

| Less: dividends paid to non-controlling shareholders | 0 |

| Equals non-controlling interest at the date of consolidation | $11.75 million |

by Obaidullah Jan, ACA, CFA and last modified on