Excel FV Function

FV is an Excel function that calculates the future value of (a) a finite stream of equidistant equal periodic cash flows or (b) a single cash flow at time 0. All the periodic cash flows must be of the same amount, there must be equal time period between them and the whole cash flow stream must be subject to a constant interest rate.

Syntax

FV function syntax is:

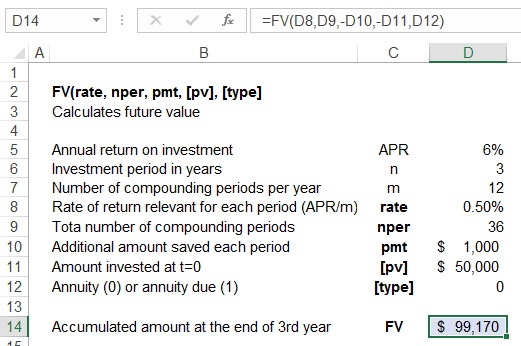

FV(rate, nper, pmt, [pv], [type])

Rate species the periodic interest rate, it equals annual percentage rate divided by the number of compounding periods in a year.

NPER shows the total number of periods in the cash flows stream, it equals total number of years (say n) multiplied by the number of compounding periods per year (say m).

PMT shows the amount of periodic equal cash flows. Cash flows must be equally spread out which means there should be equal duration between each cash flow.

PV is an optional value when calculating the future value of a stream of cash flows, it represents any single sum included in the cash flows stream that occur at time 0. In case where there are no periodic cash flows and we are looking to find future value of a single cash flows; this PV argument represents that single cash flow at t=0.

[type] argument is 0 by default, representing a situation where cash flows at occur at the period end. If the cash flows in the stream occur at the start of the period, we need to enter 1. While calculating the future value of a stream of cash flows, the arguments in square brackets are optional while all other arguments are mandatory but in calculating the future value of a single cash flow, since PMT argument is blank or zero, a PV must be there.

Example

You have been saving some money for your graduate studies which you plan to start in 3 years. You currently have $50,000 which you have invested at 8% compounded monthly and you plan to invest an additional $1,000 each month for the next three years. You might be interested in calculating the total accumulated value of your savings by the end of 3rd year.

You need to keep the following three things in mind while using the FV function: (a) the interest rate and NPER units must match, i.e. monthly interest rate where duration of each period is one month, (b) where the cash flows have opposite direction, their signs must be opposite too, i.e. representing outflows with negative sign, and (c) Excel assumes an annuity by default, so in case of an annuity due, you need to enter 1 in the [type] argument.

by Obaidullah Jan, ACA, CFA and last modified on