Fixed Costs

Fixed costs are costs which do not change with change in output as long as the production is within the relevant range. It is the cost which is incurred even when output is zero.

Fixed cost, variable cost and mixed cost are three classes into which costs are classified based on their behavior. A variable cost is a cost which varies directly with output and a mixed cost is a cost which has both a fixed and a variable component.

Whether a cost is classified as fixed or variable depends primarily on the length of time period under consideration. Many costs which are fixed in the short-run become variable in the long-run. For example, if a company has signed a non-cancellable lease for 1 year, the cost is fixed if the time period is one year or less but a variable cost when our time frame is more than 1 year.

Fixed costs can be further classified into (a) committed fixed costs and (b) discretionary fixed costs depending on the flexibility that management has in reducing them.

Average fixed cost equals total fixed costs divided by output. Within the relevant range, the average cost falls and the average fixed cost curve declines with increase in output. In other words, total fixed cost remains the same but the fixed cost per unit changes with change in output.

Examples of Fixed Costs

Different methods are employed to identify whether a cost is fixed. These include industrial engineering method, account analysis method and quantitative methods such as high-low method, regression analysis method, etc.

Following are costs which are typically fixed in nature:

- Salaries of supervisory and management staff: a company needs only one chief executive officer, chief financial officer regardless of the output level.

- Plant depreciation: Since plant size can’t be changed in the short-run, related depreciation expense doesn’t change with change in output.

- Rent of office premises: Rent contracts are typically signed for more than 1 year. If the output is reduced, rent cost remains the same.

- Regulatory and license fees: In most cases, a company must obtain and renew relevant licenses whose costs do not depend on the company’s output level.

- Insurance of plant and machinery: It is because insurance premiums are related to historical cost/recoverable amount of the insured asset instead of revenue.

- Lease and interest payments: Lease and loan payments are based on the principal balance of loan and the interest rate and it has not relationship with sales level.

Example

Kick, Inc. manufactures footballs. Following are details of the company’s fixed costs:

- Current capacity of its plant is 200,000 units per annum. In order to produce output of 400,000 the company must double the plant size. Current depreciation expense is $10,000,000.

- Insurance, property taxes and other fixed charges are 10% of the plant depreciation.

- Raw materials of $10 and labor of $20 are spent on each football.

- Total salaries of supervisory staff who are permanent employees is $1,000,000 per annum. If a new plant is produced, such staff must be doubled.

- Salaries of CEO, CFO and other top-level executives are $2,000,000 which will remain the same even if the plant size doubles.

Identify which of these are fixed costs and create relevant range chart.

Solution

The following table shows fixed costs for different output levels:

| Output Level | 0 | 100000 | 200000 |

|---|---|---|---|

| Plant depreciation | $ 10,000,000 | $ 10,000,000 | $ 20,000,000 |

| Insurance, property taxes and other charges | 1,000,000 | 1,000,000 | 2,000,000 |

| Supervisory staff | 1,000,000 | 1,000,000 | 2,000,000 |

| Executives’ salaries | 2,000,000 | 2,000,000 | 2,000,000 |

| Total fixed costs | 14,000,000 | 14,000,000 | 26,000,000 |

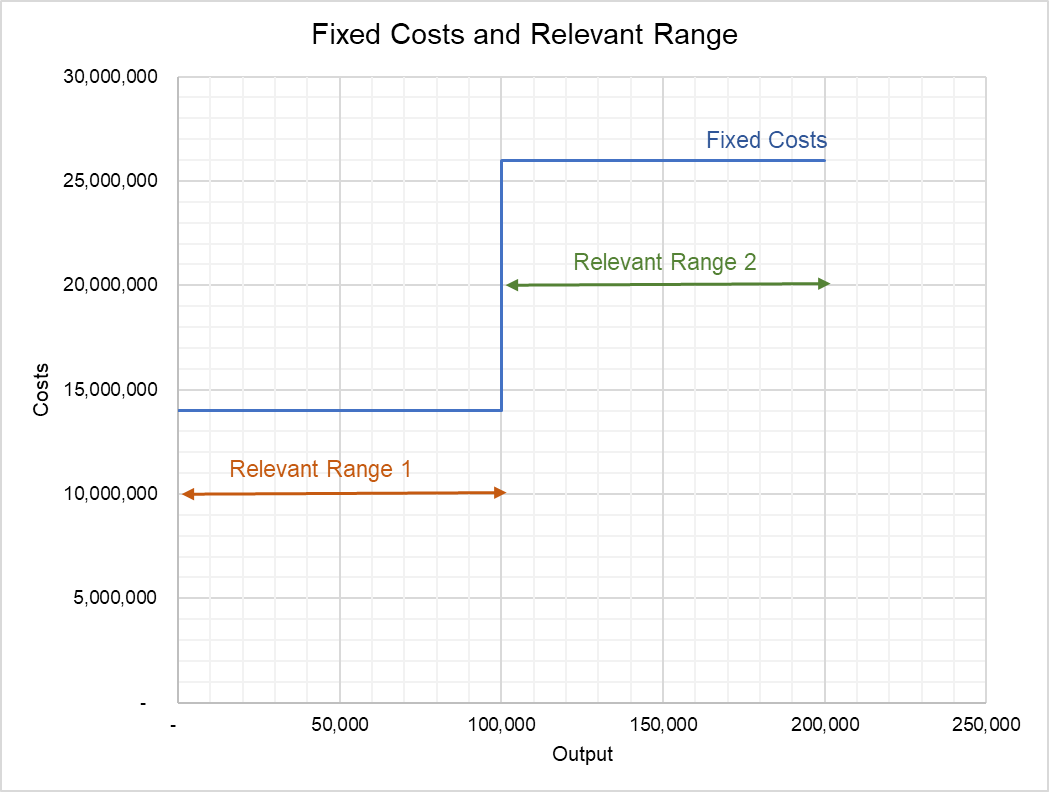

The following chart shows fixed costs and relevant ranges.

In the relevant range 1 which is from 0 to 100,000 units, total fixed costs are $14 million. It means that a fixed cost of $14 million will be incurred whether the company produces 0 units or $100,000 units. But as soon as the company wants to produce anywhere between 100,001 and 200,000 (i.e. enter relevant range 2) its total fixed costs will jump to $26 million.

by Obaidullah Jan, ACA, CFA and last modified on