Protective Put

Protective put (also known as married put) is an option strategy in which an investor purchases a put option to guard against any loss on the underlying asset which he already owns. Protective put is like insurance against loss on the underlying asset.

While protective put and married put are essentially the same in concept, in protective put the option buyer already owns the underlying asset, while in married put he invests in both the underlying asset and the put option on that asset simultaneously.

Investors buy protective put when they expect the underlying stock to increase in value but at the same time they want to remove any downside risk.

Formula

Since a protective put is made up of the underlying asset and a put option on the asset, the value of the whole position must be the sum of both components as calculated by the following formula:

Value of a Protective Put = UT + max[0, X − UT]

Profit at expiration of a protective put equals the difference between the price of the underlying asset at the expiration and the price at the inception of the strategy plus the payoff from the put option minus the premium paid on the put option. This is summarized in the following formula:

Payoff from a Covered Call = UT − U0 + max[0, X − UT] − Premium

Where, UT is the price of the underlying asset at the exercise date, U0 is the price of the underlying asset at the inception of the strategy and X is the exercise price

Example

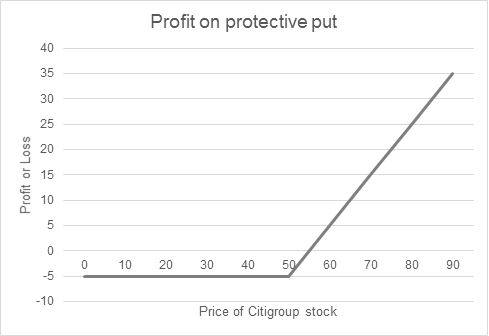

Jonathan Wong bought $100 shares of Citigroup Inc. (NYSE: C) for $30 in October 2012. The stock is currently fetching $50 per share and he is quite happy with his pick. He thinks it is more likely that the stock will go up even further in next few months. But to guard against the possibility of any drop, he bought put options on Citigroup stock. He paid $5 per option and they carry an exercise price of $50 per option.

Discuss his profit from the position if Citigroup stock price at the exercise date is (a) $100, (b) $80, (c) $50, (d) $20, and (e) 0

If Citigroup stock price at the exercise date is $0, the value of his option will be $50 [= max[0, $50 − 0]]. His total profit from the whole strategy will be -$500 as calculated using the formula below:

Profit on protective put if Citigroup stock price is 0 = 100 × ($0 − $50 + max [0, $50 - $0] - $5)

Below is the calculation of profit from the strategy at the other prices:

Profit on protective put if Citigroup stock price is $20

= 100 × ($20 − $50 + max [0, $50 − $20] − $5) = -$500

Profit on protective put if Citigroup stock price is $50

= 100 × ($50 − $50 + max [0, $50 − $50] − $5) = -$500 = -$500

Profit on protective put if Citigroup stock price is $80

= 100 × ($80 − $50 + max [0, $50 − $80] − $5) = -$2,500

Profit on protective put if Citigroup stock price is $100

= 100 × ($100 − $50 + max [0, $50 − $100] − $5) = -$4,500

The illustration just validates the plot given below for profit on protective put.

by Obaidullah Jan, ACA, CFA and last modified on