Covered Call

Covered call is an option strategy in which the option writer writes a call option on an asset he already owns. It is called a covered call because the potential obligation under the call option is covered by ownership in the underlying stock.

Covered call is just opposite to naked call, which is a strategy in which the option writer writes a call option without having any covering position in the underlying asset.

Investors write covered calls when they expect the price of the underlying stock to rise but stay below the exercise price (also called strike price). They pocket the option premium by writing the call options and hope that they expire out of the money.

Payoff Formula

Value of a covered call at expiration can be calculated using the following formula:

| Value of a Covered Call = UT − max [0, UT − X] |

Profit at the expiration from a covered is calculated as follows:

| Profit from a Covered Call = UT − U0 − max[0, UT − X] + premium |

Where,

UT = price of the underlying asset at the exercise date

U0 = price of the underlying asset at the inception of the strategy

X = exercise price

Example

Nick Mutuma works as trader at New Millennium Securities. He wrote 100 call options on Goldman Sachs Group Inc. (NYSE: GS) stock when the stock price was $155 per share. He received a premium of $10 per option for exercise price of $160. Discuss the profit from the position if price of GS stock at exercise date is (a) $220, (b) $180, (c) $160, (d) $130 and (e) 0

If price of GS stock is $220, the value of the call option will be $60 [=max of $0 and ($220 minus $160)], so the option holder will exercise it. Nick will have to sell the stock to the option holder for $160. His total profit from the position will be $1,500 as calculated below:

Profit on covered call if price of underlying is $220

= 100 × ($220 − $155 − max [0, $220 − $160] + $10)

If price of GS stock is $180, the value of the call option will be $20 and the option writer will generate a profit of $1,500:

Profit on covered call if price of underlying is $180

= 100 × ($180 − $155 − max [0, $180 − $160] + $10)

If the stock price is $150, the profit to option writer will be $1,500

Profit on covered call if price of underlying is $160

= 100 × ($160 − $155 − max [0, $160 − $160] + $10)

If the stock price is $130, the profit to option writer comes out to be -$1,500

Profit on covered call if price of underlying is $130

= 100 × ($130 − $155 − max [0, $130 − $160] + $10)

If the price is down to $0, his maximum loss will be -$14,500

Profit on covered call if price of underlying is 0

= 100 × ($0 − $155 − max [0, $0 - $160] + $10)

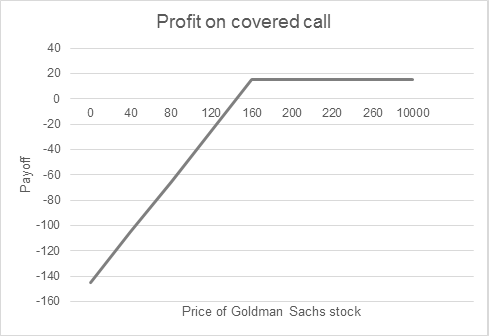

The profit calculated above can be plotted as shown below. This the profit diagram of a covered call.

by Obaidullah Jan, ACA, CFA and last modified on