GDP Deflator

GDP deflator (also called implicit price deflator for GDP) is a measure of price level of domestically-produced goods and services in an economy. It is calculated by dividing nominal GDP by real GDP multiplied by 100.

Nominal GDP for period t is the value of all final goods and services produced in an economy determined at the prices that prevail in period t. Real GDP for period t, on the other hand, is the value of total final production for period t determined at the prices of the base year b. The base year is a pivot that is arbitrarily selected as a common denominator. In the base year, nominal GDP and real GDP are equal and GDP deflator is equal to 1. In other words, GDP deflator can also be defined as the ratio of GDP calculated at current year prices to GDP calculated at base year prices.

GDP deflator is an index number, just like consumer price index, which means that its value changes with reference to the base year. The farther it moves from the base year, the more pronounced is it difference from 1.

Formula

GDP deflator (Pt) is calculated by dividing nominal GDP by the real GDP:

$$ \text{P} _ \text{t}=\frac{\text{Nominal GDP}}{\text{Real GDP}} $$

GDP deflator is an important indicator of changes in prices of domestically produced goods. The GDP deflator inflation rate is worked out as follows:

$$ \text{GDP Deflator Inflation Rate}=\frac{\text{P} _ \text{t}-\text{P} _ {\text{t}-\text{1}}}{\text{P} _ {\text{t}-\text{1}}} $$

Where Pt is the GDP deflator for period t and Pt-1 is the GDP deflator for period t – 1.

Example

BEA publishes GDP deflator for US economy. Following is an extract obtained from its website: www.bea.gov

| Year | GDP Deflator | GDP Inflation Rate |

|---|---|---|

| 2009 | 95.004 | |

| 2010 | 96.111 | 1.17% |

| 2011 | 98.118 | 2.09% |

| 2012 | 100 | 1.92% |

| 2013 | 101.755 | 1.76% |

| 2014 | 103.68 | 1.89% |

| 2015 | 104.789 | 1.07% |

| 2016 | 105.935 | 1.09% |

| 2017 | 107.948 | 1.90% |

In this data series, the base year is 2012 hence its value is 100. The GDP deflator value for periods before and after 2012 are worked out with reference to the 2012 prices. Inflation rates are calculated as the percentage difference between GDP deflator values between two periods.

Difference between CPI and GDP Deflator

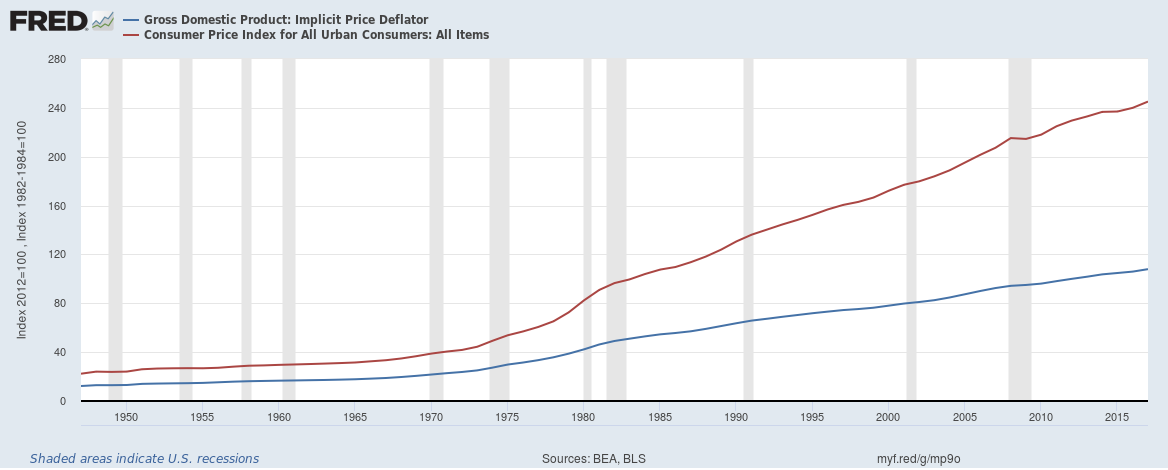

Consumer price index (CPI) and GDP deflator are both indicators of price level in an economy and they have a very high correlation coefficient. As shown by the graph below (obtained from Federal Reserve Bank of St. Loius FRED), CPI values are generally higher than GDP deflator.

Despite these similarities, they differ in important ways:

- CPI measures prices on a basket of goods consumed by urban consumers but GPD deflator measures price level for the whole GDP i.e. for personal consumption, private investment and government spending, etc.

- CPI includes effect of imported goods and services while GDP deflator only includes domestically produced goods and services.

- In US, CPI is calculated using Laspeyres formula while GDP deflator is calculated using Fischer formula.

by Obaidullah Jan, ACA, CFA and last modified on