Shutdown Point

In short-run, a firm should shut down immediately if the market price of its product is lower than its average variable cost at its profit-maximizing output level. In long-run, it should shut down if the price of its product is less than its average total cost.

We have defined two different shutdown conditions for a single firm because the shutdown decision depends on which of its costs the firm can avoid by shutting down.

Short run is defined as a time period in which at least one of a firm’s inputs, say capital, is fixed. It means that at least some of the firm’s costs will be fixed which will be incurred even if it shuts down.

Long run, on the other hand, is a period in which a firm can change all its inputs. In other words, the firm has no fixed costs to worry about in the long-run. If it shuts down in the long-run, all its costs go away too.

Short-run Shutdown Decision

Because fixed costs are costs which a firm continue to incur even if production falls to zero, a firm should continue production if its revenue covers its variable cost. It is because when its revenue is higher than its variable cost, at least there is something left behind to cover a part of the fixed costs which will be incurred anyway. This is why the short-run shutdown point occurs when price P is less than or equal to the average variable cost at the profit-maximizing point. This can be expressed mathematically as follows:

$$ \text{P}\le \text{AVC} $$

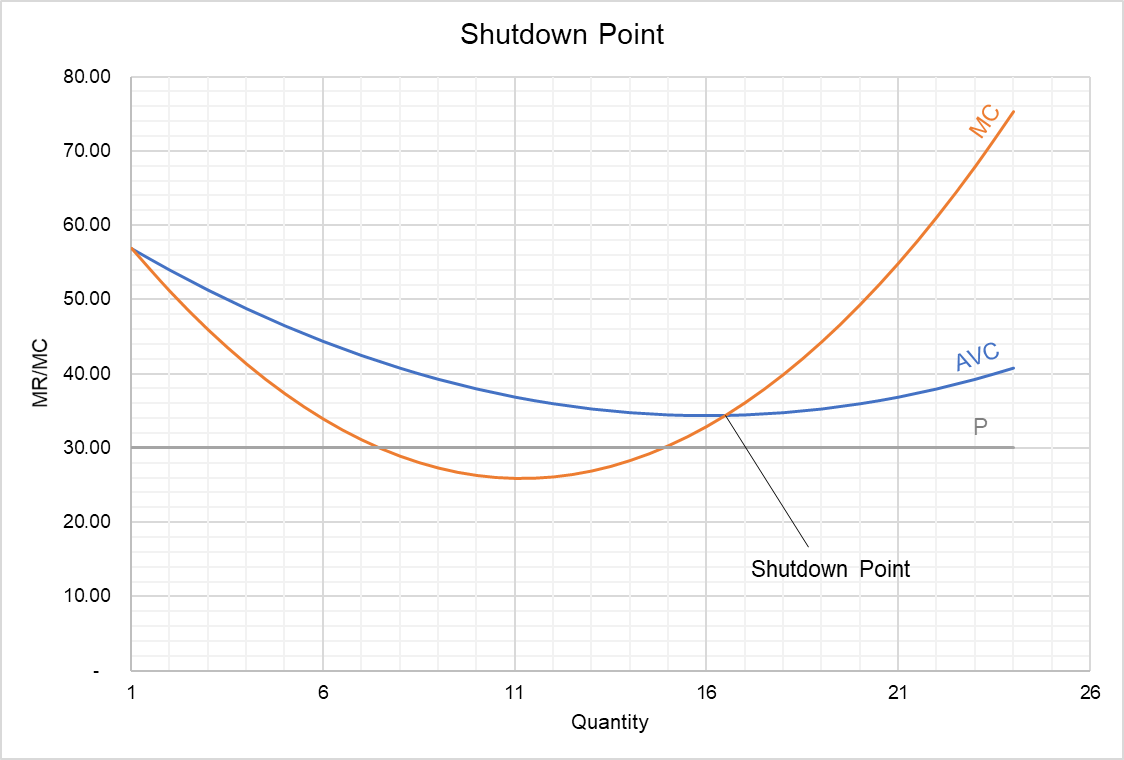

The following graph shown a firm’s shut-down point in short-run.

The profit-maximizing (optimal) output level occurs when marginal revenue is equal to marginal cost. You can see that even at this optimal level, the price curve is below the average variable cost (AVC) curve. It means that the firm is incurring losses at this price and it should shut down.

Shut-down Price

The price at which a firm should shut down even in the short-run is called the firm’s shutdown price. Shutdown price is equal to a firm’s minimum possible average variable cost. It is because the firm will never be able to achieve an average variable cost lower than this and if the market price is less than even the lowest-possible average variable cost, there is no output level at which the firm will earn positive contribution margin. It doesn’t make sense for a firm to keep producing if the sales revenue will not cover even the variable costs at a firm’s optimal output.

Long-run Shutdown Decision

Shutdown decision in the long-run is different because all costs can be avoided in the long-run. In the long-run, a firm should shut down if its revenues do not cover its total costs.

Let’s derive the firm’s long-run shutdown point.

We know a firm should shut down in the long-run if its profit is zero or if it is making losses. If π is profit, TR is total revenues and TC is total costs, the shutdown condition can be written as follows

$$ \pi\le \text{TR}\ - \text{TC} $$

Dividing both sides by Q

$$ \frac{\pi}{\text{Q}}\le\frac{\text{TR}}{\text{Q}}\ - \frac{\text{TC}}{\text{Q}} $$

Π/Q should be zero because at shutdown point, profit must be zero. TR/Q equals price and TC/Q equals average total cost (ATC).

$$ \text{0}\le \text{P}\ - \text{ATC} $$

Just a bit of rearrangement (please note that we are dealing with an inequality):

$$ \text{P}\le \text{ATC} $$

It shows that a firm should shut down in the long-run if price is less than average total cost.

by Obaidullah Jan, ACA, CFA and last modified on