Kinked Demand Curve Model

The kinked-demand curve model (also called Sweezy model) posits that price rigidity exists in an oligopoly because an oligopolistic firm faces a kinked demand curve, a demand curve in which the segment above the market price is relatively more elastic than the segment below it.

An oligopoly is a market structure in which there are a small number of large firms and high barriers to entry. In such an environment, each firm has significant market power. Hence, firms must consider possible actions of their competitors in taking their pricing decisions.

The kinked demand model postulates that when a firm increases it price, its competitors do not change their prices. This causes the demand for goods produced by the firm attempting the price increase to fall. In other words, the firm faces a very flat demand curve above the market price. On the other hand, when the firm decreases its price, its competitors follow suit. Since all firms reduce their prices, there is no gain in market share for any firm. The increase in sales is restricted only to the increase in quantity demanded due to lower market price. This is illustrated by a steeper demand curve below the market price.

Kinked Demand Curve and Price Rigidity

A kinked demand curve is composed effectively of two demand curves which meet at the prevailing market price. At a price higher than the prevailing market price, a firm faces a more elastic demand curve but at a price below the prevailing market price, the demand curve is relatively less elastic. This introduces the disconnect i.e. a kink in the demand curve at the current market price.

As explained by the kinked demand model, any increase in price is bound to result in drop in market share of the firm and any decrease in price is not going to result in any gain in market share. Further, firms fear that any downward revision in price may trigger a price war. This results in significant price rigidity in an oligopoly.

Due to the kinked nature of the demand curve, an output range exists in the marginal revenue curve is vertical such that any change in marginal cost do not impact the profit-maximizing output level and consequently the price level.

Example

Arryn, Inc. manufactures gaming consoles.

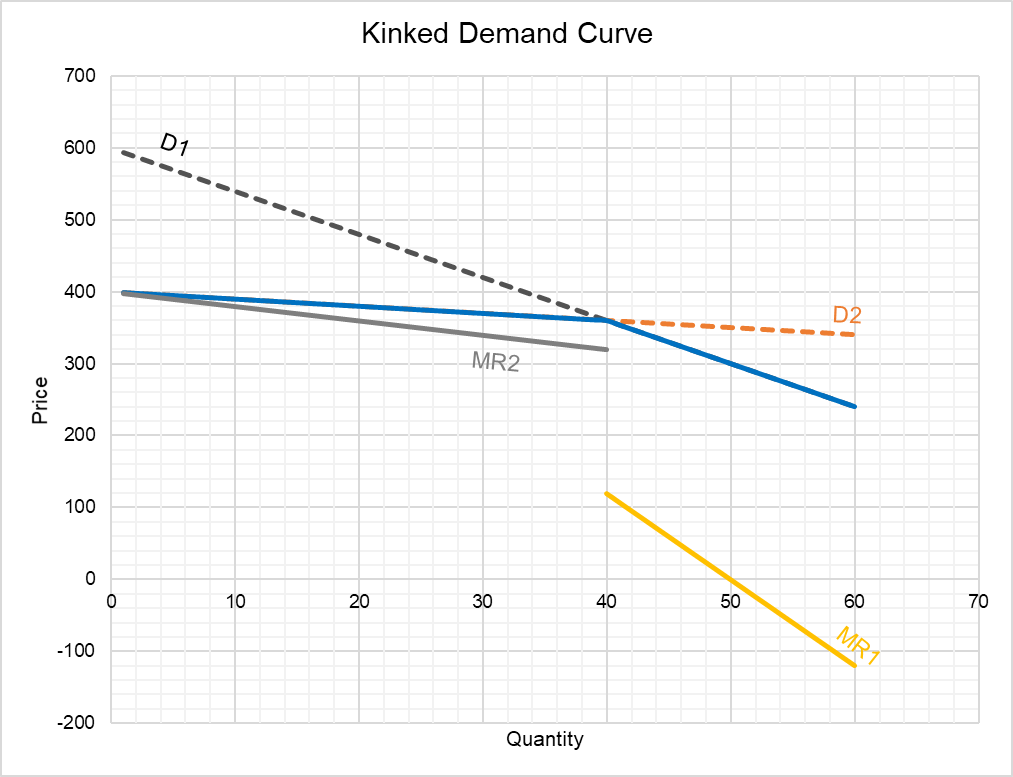

If there is no price competition, it faces a demand curve D1 given by the following demand function:

$$ \text{P}\ =\ \text{600}\ -\ \text{6Q} $$

Alternatively, if other firms strongly match it price, its demand curve is D2:

$$ \text{P}\ =\ \text{400}\ - \text{Q} $$

The following chart plots both the demand curves.

When the firm increases its price, but its competitors do not, it loses a significant amount of its sales. This is represented by the demand curve D2. But when the firm decreases its price, its competitors also respond leading to no gain in market share for the firm. This is evident by the steeper demand curve D1.

The marginal revenue curve facing the firm is discontinuous. MR2 is relevant for prices above the market price and MR1 reflects the situation at prices below the prevailing price. At the output level of 40, the marginal revenue curve is vertical. Let’s assume that he marginal cost curve intersects marginal revenue at this point such that 40 is the profit-maximizing output which corresponds to a price of 360. It means that even if there is any change in marginal cost at this output level, there is no change in profit-maximizing output level. If there is no change in profit-maximizing output, there is no change in price. This shows that the prices are sticky in an oligopoly.

by Obaidullah Jan, ACA, CFA and last modified on