Perfect Competition

Perfect competition (also called pure competition) is a market structure characterized by no barriers to entry or exit, large number of price-taking market participants and a homogeneous product.

Even though exactly perfectly-competitive markets are rare, markets for agricultural commodities, financial services, housing services, etc. closely resemble perfect competition. Perfect competition is theoretically a very important construct because Adam Smith’s invisible hand operates only in perfect competition. It is a model which maximizes the sum of consumer surplus and producer surplus.

Characteristics of Perfect Competition

The perfect competition model is founded on three assumptions: price-taking nature of all market participants, undifferentiated/standardized products and no barriers to entry or exit.

Price-taking

The most fundamental characteristic of perfect competition is that all market participants (both producers and consumers) are price-takers. It means that they take the market price as given. If a producer attempts to sell its product at a price higher than the market price, it won’t be able to sell anything. In other words, in perfect competition, no firm can influence the market price on its own. It doesn’t mean that the market price can’t change. It can change but through the collective movement of the market as a whole and not due to action of any one producer or consumer.

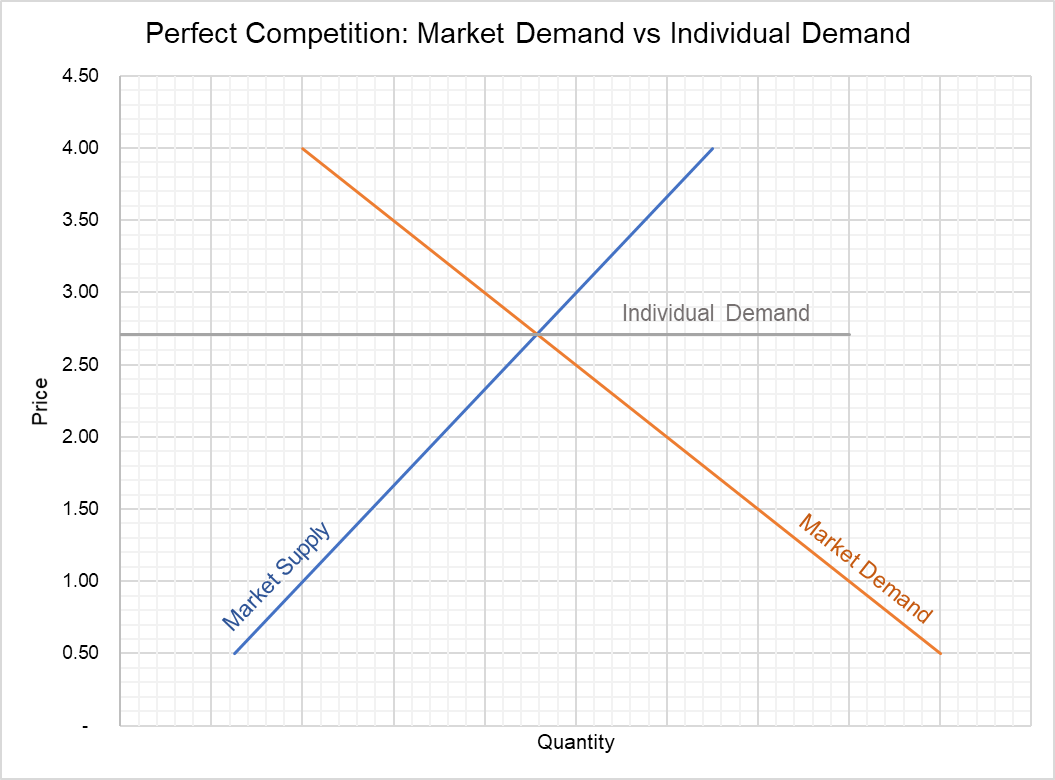

It follows that even though the market demand curve is downward-sloping, the demand curve faced by each individual firm is a horizontal. For each firm, marginal revenue, the additional revenue obtained from selling one additional unit, is equal to the current market price.

Homogeneous Product

Second most important determinant of perfect competition is the nature of the product. Perfect competition occurs only where the product traded in the market is homogenous i.e. it is standardized such that a buyer can’t tell the difference between the products of Firm A and Firm B. This assumption is important because due to standardized nature of the product, units produced by Firm A and Firm B are perfect substitutes.

If there is a difference between quality or even perception of a difference, consumers might be willing to pay a premium to the firm whose quality they consider to be superior. If a perfectly-competitive market introduces differentiated products, it is more like a monopolistic competition.

Barriers to Entry or Exit

The third critical assumption in perfect competition is that the existing firms can’t stop any new firms from entering the market or existing firms from leaving the market. It means that there are no patents, copyrights or other legal hurdles or even economic hurdles such as economies of scale, increasing returns to scale, etc.

This assumption is important because it ensures that no firm earns positive economic profit in the long-run. If the market is profitable in the short-run, new firms will enter the market, and this would return the market to zero economic profit. Similarly, if existing firms are incurring loses, some of them will exit the market and the remaining firms would start earning zero economic profit.

Examples

Example 1

Let’s consider Bugda Farms, one of the 250 equal-sized farms in Agraria who are engaged in cultivation of wheat. There are some 50 firms who purchase wheat in the market, including bakers, flour mills, wholesale traders, retailers, etc.

In determining whether the market is perfectly-competitive, we need to ask the following three questions: * Whether the number of buyers and sellers are so large that a single one (or even a few of them) can’t influence the market price? * Whether any new firms are barred from entering or exiting the market? * Whether consumers prefer wheat produced by Bugda Farms over any other, say Sitari Farms?

Let’s imagine what would happen if Bugda attempts to sell its wheat for $200 per ton while all other farms sell theirs at $180. No one will buy from Bugda as long as they can buy in the market at $180. It shows that Bugda can’t influence the market price. Our first condition of perfect competition is met.

Since there is no restriction on the type of crop in Agraria, farmers can switch from other crops to wheat or from wheat to other crops. This satisfies the second requirement of the perfect competition model.

Since wheat is wheat, a consumer can’t reasonably prefer wheat from Farm A over wheat from Farm B. This shows that the third condition is also met.

We can conclude that the market embodies perfect competition.

Example 2

Now let’s consider Sucrose Farms, one of 100 sugar-cane farms in a district where there is only one sugar mill. Imagine that the cost of transporting the sugar cane to any other district is too much.

Since there is only one buyer, the market doesn’t meet the first condition of perfect competition. It is in fact a monopsony, a market structure in which there is only one buyer and multiple producers.

by Obaidullah Jan, ACA, CFA and last modified on