Oligopoly Models

An oligopoly is a market structure characterized by significant interdependence. Common models that explain oligopoly output and pricing decisions include cartel model, Cournot model, Stackelberg model, Bertrand model and contestable market theory.

The reason there are more than one model of oligopoly is that the interaction between firms is very complex. It depends on whether the product is homogeneous or differentiated, whether there is a dominant firm, whether firms compete based on output or price, etc.

Cartelization

An oligopoly can maximize its profits by colluding and forming a cartel. When they do so, they are effectively a monopoly and they can maximize the industry profits by producing at an output level at which the industry marginal revenue is equal to industry marginal cost.

Despite the significant advantage of cartelization, cartels are rarely successful. First, because collusion and price-fixing are illegal in most jurisdictions. Second, individual firms have an incentive to cheat the cartel. Since every individual firm can be better off if they cheat the cartel, a cartel is inherently unstable.

Cournot Model

The Cournot model of oligopoly applies where (a) the firms produce homogeneous goods, (b) they compete simultaneously on output and market share, and (c) they expect their rivals to not change their output in response to any change that the make.

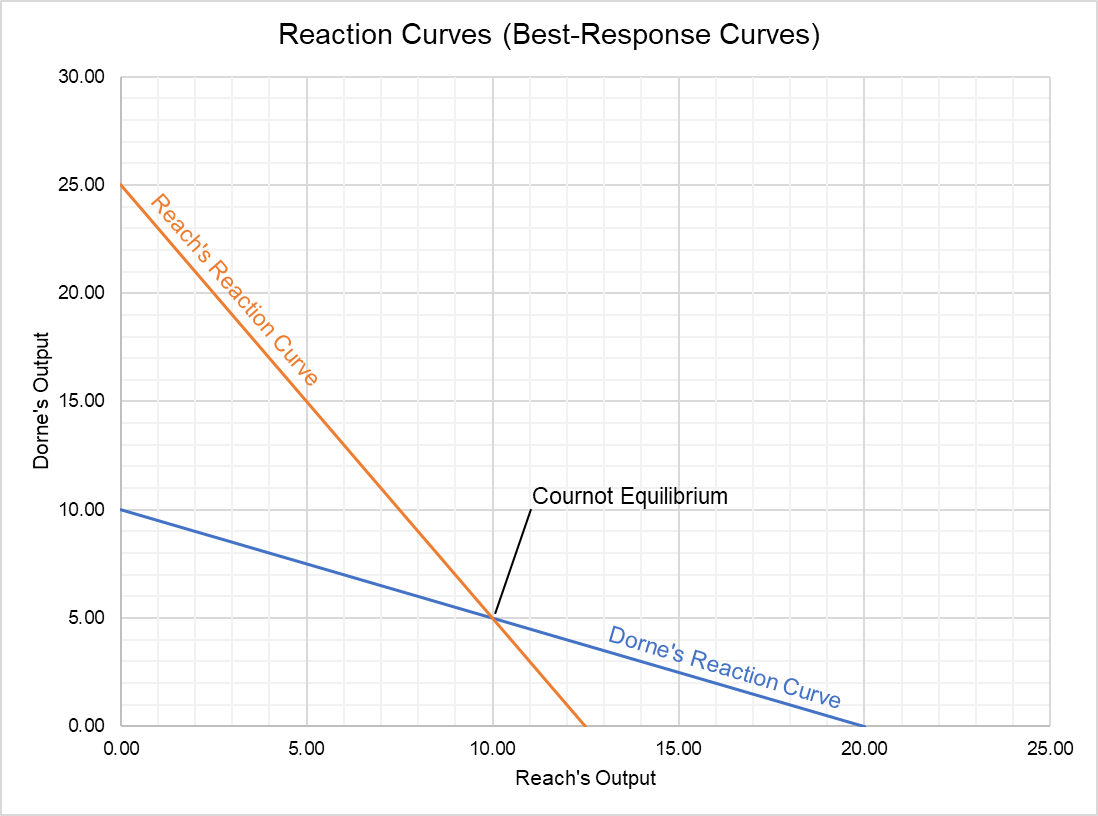

Cournot equilibrium is the output level at which each firm in the oligopoly maximizes its profit given the output level of all other firms. No firm can gain from changing its output level away from Cournot equilibrium because the response of other firms will wipe out any additional profit. Cournot equilibrium is the point of intersection of the best-response curves (also called reaction curves) of the firms. If there are two firms, Reach and Dorne, the reaction curve of Dorne plots Dorne’s profit-maximizing output given different output levels of Reach and vice versa. As shown in the graph below, the Cournot equilibrium is the point of intersection of both reaction curves.

Stackelberg Model

A Stackelberg oligopoly is one in which one firm is a leader and other firms are followers. This model applies where: (a) the firms sell homogeneous products, (b) competition is based on output, and (c) firms choose their output sequentially and not simultaneously.

The leader is typically a first-mover who chooses its output before other firms can do it. Since other firms must set their output decision given the leader’s output decision, the leader in a Stackelberg oligopoly typically has a bigger market share and higher profit than other firms in the oligopoly.

Bertrand Model

There are two versions of Bertrand model depending on whether the products are homogeneous or differentiated.

The homogeneous-products Bertrand model of oligopoly applies when firms in the oligopoly produce standardized products at same marginal cost. When the marginal cost is same, it is in the best interest of each firm in oligopoly to undercut its rival (i.e. beat its price), because the other firms are also trying to beat it. This price war leads to a situation at which market price is equal to the marginal cost. The output and price level in a Bertrand oligopoly is the same as in perfect competition.

The differentiated-products Bertrand model contends that when an oligopoly produces differentiated products, price competition doesn’t necessarily lead to a competitive outcome. It is because when each firm produces a differentiated product, its demand doesn’t become zero when it raises its price. In fact, the Bertrand model concludes that if one firm increases it price, the other firms in a differentiated oligopoly should also increase theirs because this will increase its profit.

Contestable Market Theory

Contestable market theory posits that when the initial investment required in an oligopoly is not a sunk cost i.e. where most of the investment can be recovered if a firm decides to leave the market, the industry functions more like a perfect competition. It is because the recoverability of the investment encourages new firms to get a go at the industry and this eliminates any positive economic profit.

The following matrix compares different aspects of the common oligopoly models:

| Cartel | Cournot | Stackelberg | Bertrand (homogeneous products) | Bertrand (differentiated products) | |

|---|---|---|---|---|---|

| Nature of competition (output vs price) | Output-setting | Output-setting | Output-setting | Price-setting | Price-setting |

| Nature of product | Homogeneous | Homogeneous | Homogeneous | Homogeneous | Differentiated |

| Economic profit | Maximum | >0 | >0 | 0 | >0 |

| Output | Minimum | Medium | Maximum | Medium | |

| Sequential or simultaneous | Simultaneous | Simultaneous | Sequential | Simultaneous | Simultaneous |

by Obaidullah Jan, ACA, CFA and last modified on