Oligopoly

An oligopoly is a market structure in which a few firms have each such a large market share that any change in output by one firm changes market price and profit of other firms. A member of an oligopoly is called an oligopolist.

Real life examples of oligopolies include microprocessors, personal computers, airlines, tobacco, pharmaceuticals, soft drinks, operating systems, etc.

An oligopoly of only two firm is called a duopoly, for example Intel and AMD in case of microprocessors. Similarly, an oligopoly of three firm is called a triopoly, for example Microsoft, Nintendo and Sony in case of game consoles.

Characteristics

We defined oligopoly as a market structure in which each firm has some market power but there are other important features of oligopoly:

- Significant barriers to entry exist such as high investment requirement because of a high minimum efficient scale (due to increasing returns to scale), control of critical natural resource (such as oil, mercury), etc.

- The product they sell might be differentiated (for example in automobiles) or standardized (such as steel, crude oil, copper).

- There is an incentive for firms to collude and form a cartel because they know that a price war is zero-sum game and that cartelization can increase the oligopoly profits to monopoly level.

- There is price-rigidity because firms fear that any price change will trigger price war.

Concentration Ratio and HHI

An oligopoly is sometimes defined as a market with a small number of firms. But this definition assumes that many niche producers are not part of the market. For example, Rogers, Bell and Telus are the major mobile network operators in Canada but there are many smaller regional firms too. This is why instead of looking at the number of firm in a market, it is better to find out what proportion of the market is controlled by the top few firms. Measures such as four-firm concentration ratio and Herfindahl-Hirschman Index (HHI) are important indicators of oligopolistic tendency of a market. HHI of 2,500 or higher indicates that the industry is an oligopoly.

Oligopoly Competition

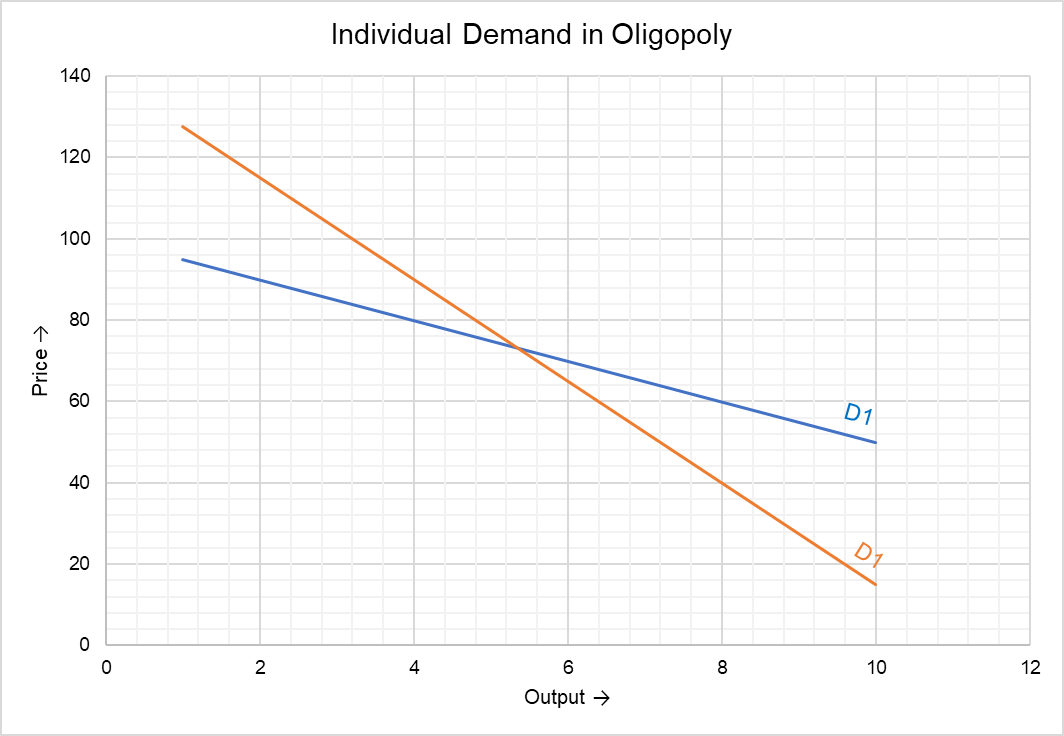

Since every firm in an oligopoly can influence market price, each firm must take into consideration the likely response of other firms while setting its price and output level. For example, an attempt by one firm to capture market share by reducing its price and thus increasing its output can result in a fierce price war eliminating any positive economic profit. D1 in the graph below shows a firm’s demand curve if its demand is it rivals do not match its price and output changes while D2 is the demand curve if its price changes are matched. You can see that D2 is steeper which means that a firm’s quantity demand falls more drastically in response to change in its price.

Importance of such strategic interactions in an oligopoly makes it the most interesting and important market structure.

Types of Oligopoly

Oligopolies are classified into different types based on nature of product being sold (pure/perfect vs imperfect/differentiated), existence of price-leadership (partial vs full), collusion (collusive vs non-collusive).

Pure/Perfect Oligopoly vs Differentiated/Imperfect Oligopoly

A pure oligopoly is one in which there is a homogeneous product, for example OPEC is a pure/perfect oligopoly. Same is the case of oligopolies of other commodities such as mercury, copper, etc. A differentiated oligopoly, on the other hand, is one in which the product of different firms is perceived to be different, for example automobile and smartphone industries are differentiated oligopolies.

Collusive Oligopoly vs Non-Collusive Oligopoly

A collusive oligopoly in one in which the member firms engage in price-fixing and cartelization, for example OPEC. A non-collusive oligopoly in one in which there is no tacit understanding between the member firms regarding pricing and output. Since price-fixing and cartelization is illegal in most developed countries, most of oligopolies in US and Europe, etc. are non-collusive oligopolies.

Partial Oligopoly vs Full Oligopoly

A partial oligopoly is characterized by one large producer which leads other firms in the oligopoly in pricing and output decision. It is called partial oligopoly because the output and pricing decisions are sequential. A full oligopoly, on the other hand, is a market in which firms have to decide about their pricing and output decisions simultaneously.

Tight Oligopoly vs Loose Oligopoly

A tight oligopoly occurs when the four-firm concentration ration is higher than 60. A loose oligopoly, on the other hand, is one in which the four-firm concentration is in the range of 40-60.

by Obaidullah Jan, ACA, CFA and last modified on