Roth IRA

Roth IRA is an individual retirement arrangement which does not entitle an individual to claim the contributions made to the account as tax deductions, but allows those after-tax contributions to accumulate tax-free and entitles the individual to tax-free distributions when some relevant conditions are met.

Unlike a traditional IRA which allows tax relief at the time a contribution is made to the account, a Roth IRA allows tax relief at the time of distributions from the account.

To Roth or not to Roth: Roth IRA should be preferred if the account holder expects his tax rate to be higher in future. The advantage of this strategy is demonstrated in the example below.

Contribution limits

An individual or a family can designate a retirement account as a Roth IRA if they meet the following conditions related to contributions to the account:

- The total of contribution to all IRAs (both Roth IRA and traditional IRAs) is not more than $5,500 ($6,000 if aged 50 or older).

- The contributions are below the limits specific to Roth IRA given here.

Qualified Distributions

Only qualified distributions out of Roth IRA enjoy tax advantage. Qualified distributions are withdrawals out of the Roth IRA that are made in a period after 5-years of contributions have been made, and they are made (a) on or after the date the individual reaches an age of 59½, (b) made (earlier than age of 59½) due to disability or (c) made to beneficiaries after death of the account holder.

Withdrawals that do not satisfy the criteria for qualified distributions may be taxable.

Calculation Example

Tokuhisa Tajima is a 35 years old systems engineer. He and his family has modified adjusted gross income (AGI) of $120,000 in 20Y3. His employer does not offer any pension plan, so he is interested in setting up an IRA with annual contributions of $5,000. He plans to withdraw all the accumulated balance in the account at his retirement, which is due to occur at age 60. His current tax rate is 15% and his tax rate in 25 years will be 20%. He expects to earn 7% on his investments. Which type of individual retirement account should Tokuhisa prefer?

Solution:

Scottrade offers a good IRA calculator available here.

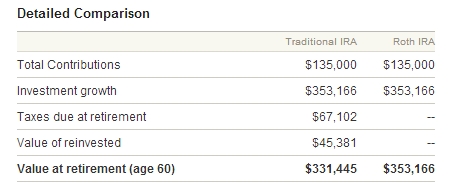

Feeding the data in the calculator, we get the following comparison:

Tukihisa should set up a Roth IRA because it will generate maximum after-tax value at retirement. It is because Roth IRA distributions are tax-free and hence the zero taxes due at retirement. Traditional IRA contributions are tax deductible but its distribution is taxable and hence the figure for taxes due at retirement for traditional IRA. The value of reinvested taxes represent the future value of tax saving due to tax deductibility of contributions in a traditional IRA.

The following publication by IRS explains the rules for Roth IRA eligibility, contributions and withdrawals in detail: Roth IRA.

by Obaidullah Jan, ACA, CFA and last modified on