Liquidity Trap

Liquidity trap (also called zero lower bound) is a situation in which nominal interest rates is already close to zero and any further increase in money supply does not have any expansionary effect.

Liquidity trap limits the monetary expansion and reduces the effectiveness of monetary policy in combating recessions. It is called liquidity trap because any increase in money supply does not result in any decrease in the interest rate and the economy is trapped in liquidity (i.e. excess money). It is called zero lower bound because the zero nominal interest rate acts as a floor on the interest rate. The nominal interest rate can’t be negative.

In response to a recession, central banks (such as US Federal Reserve) decreases the nominal interest rate. It does so by carrying open market operations in which its traders buy treasury bonds from banks. The purchase of bonds involves transfer of money to banks which increase their reserves and increases money supply. This process works effectively when the nominal interest rates are sufficiently high. But as soon as the interest rates gets close to zero, any further increase in money supply does not result in any associated decrease in interest rates. Since interest rates are stuck at the lower bound, expansionary monetary policy doesn’t work.

Imagine the economy as a car driven by the central bank. When the bank presses the pedal, it allows more gas (money) to enter the engine and this causes increase in engine thrust. But as soon as the car is at its top speed, pressing the pedal further down doesn’t work i.e. any further increase in flow of gas to the engine doesn’t result in increase in speed. Just like the engine is trapped in excess gas, in liquidity trap the economy is submerged in excess money which is no longer effective in decreasing interest rates.

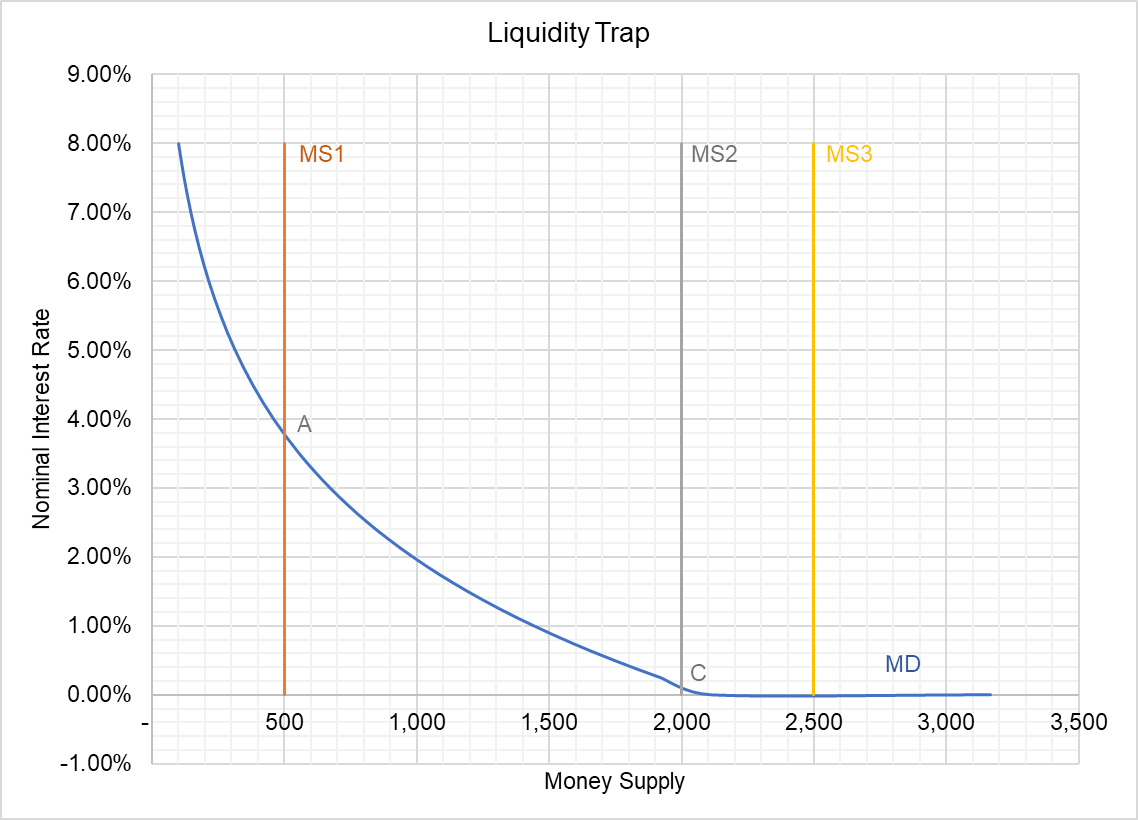

Graph

The following graph plots the relationship between nominal interest rate and money supply.

At point A the economy initially has a money supply of $500 billion and nominal interest rate of 3.8% represented by the intersection of money demand curve MD and money supply curve MS1.

The central bank can reduce the interest rate by increasing the money supply. If it increases the money supply to MS2 i.e. from $500 billion to $2,000 billion, it can bring the interest rate very close to zero. But any further increase in money supply, for example from MS2 to MS2 will not result in any decrease in interest rate. The economy is said to have entered a liquidity trap.

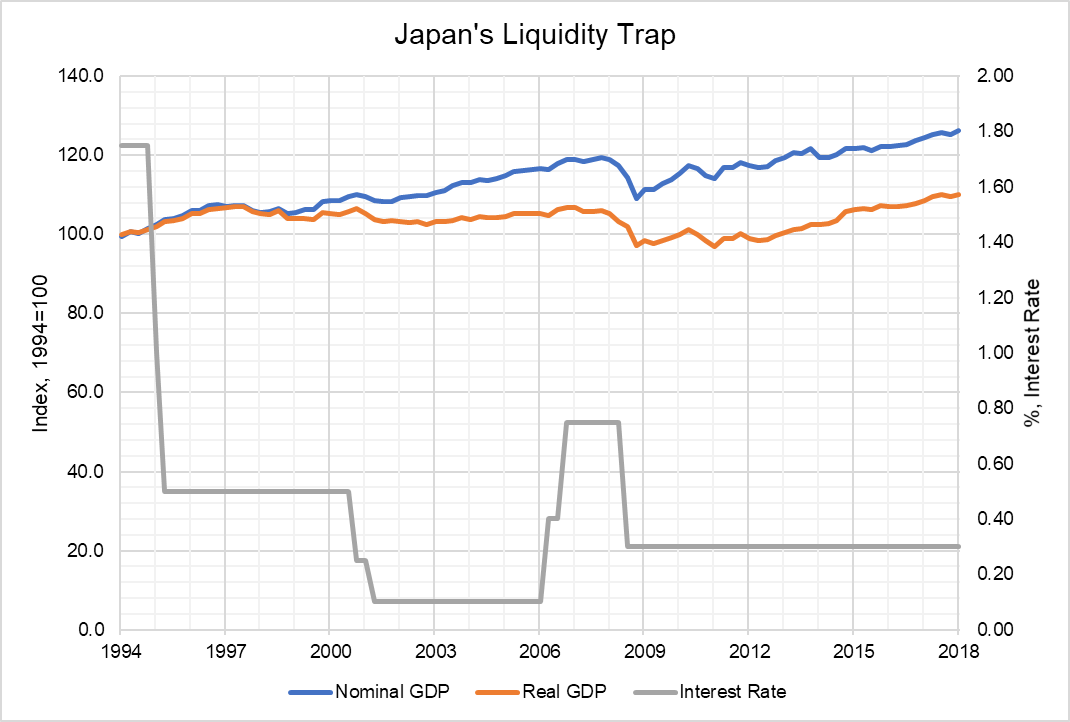

Example - Japan

Japan has been stuck in a liquidity trap since 1990. The growth has been stagnant despite very low interest rates as shown below.

Reasons for the sustained liquidity trap include: (a) intermittent and volatile fiscal stimulus, (b) non-commitment of sustained low interest rates, (c) aging population, (d) low population growth rate, etc.

Overcoming Liquidity Trap

The key to overcoming the liquidity trap is to create inflationary expectations so that the nominal interest rates rise. This can be achieved through expansionary fiscal policy and unconventional monetary policy. In an expansionary fiscal policy, governments either increase their spending or decrease taxes or both in order to increase aggregate demand which induces an increase in consumption and investment.

Unconventional monetary policy advocates using forward guidance and quantitative easing. Forward guidance is when the central banks commit to keeping the interest rates low well into future. Promise of sustained lower interest rate gives business more confidence in undertaking new investments which stimulates consumption. Quantitative easing occurs when central banks purchase long-term bonds in an attempt to reduce the long-term interest rates. Both these tools show that monetary policy is not entirely useless in fighting liquidity trap.

by Obaidullah Jan, ACA, CFA and last modified on