Core Inflation

Core inflation is a measure of changes in prices of goods and services that offer a long-run view of purchasing power by excluding volatile commodities such as food and energy items.

The inflation measure for the whole basket of goods and services that form part of the consumer price index is called the headline inflation. While the headline inflation gives us a complete picture of price level, it is prone to short-run price shocks. Prices of food and energy items are relatively more volatile because (a) their supplies are subject to weather (in case of food) and politics (in case of energy), and they have a low elasticity of demand and very steep demand curve. This is what makes core inflation more useful when we are interested in finding out the overall trend of prices.

There are two measures of core inflation: core CPI inflation and core personal consumption expenditures (PCE) inflation.

Core CPI Inflation

Consumer price index (CPI) is the most widely used measure of inflation for consumers. It is calculated using prices of a fixed basket of goods and services which a typical urban consumer buy. CPI employs the Laspeyres formula in aggregating different goods and services which means that the weights of different items in the basket are not revised each year. Core CPI inflation is calculated using price and weights data for items other than food and energy.

Even though CPI is a very popular measure, it tends to overstate inflation. Even core inflation measure calculated based on CPI has an upward bias. It is because it doesn’t factor in the substitution effect i.e. it doesn’t reduce the weight of goods and services whose prices rise and eventually their quantities fall. This is where the personal consumption expenditure (PCE) deflator is more useful.

Core PCE Index Inflation

The PCE deflator index is calculated by dividing the nominal personal consumption expenditure (PCE) component of GDP by the real PCE multiplied by 100. Core PCE deflator equals nominal personal consumption expenditure minus nominal food and energy expenditures divided by real PCE multiplied by 100.

The inflation measure that uses personal consumption expenditure (PCE) deflation is the preferred measure of price level because it (a) allows for substitution of goods and (b) provides a broader basket of goods and services than CPI.

Example

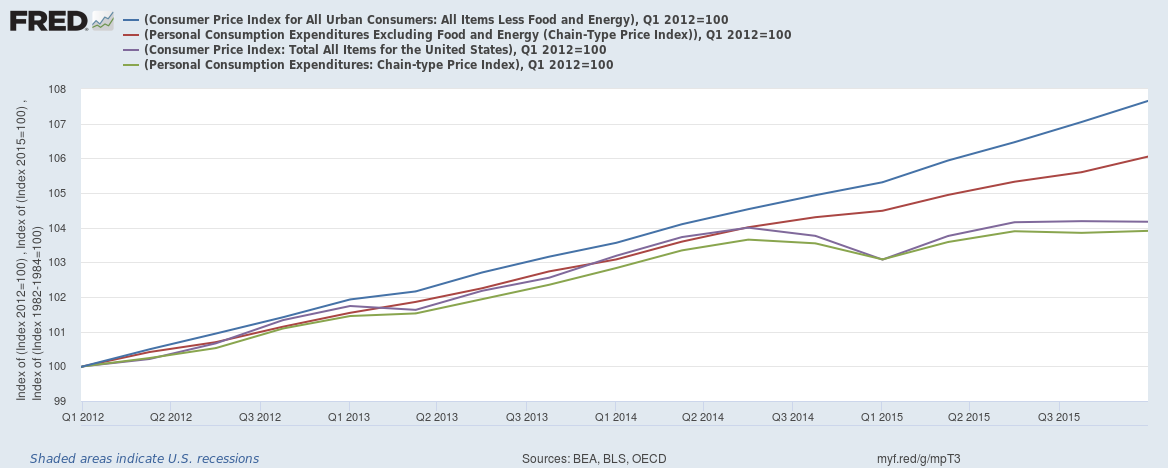

The following chart from Federal Reserve Bank of St. Louis FRED compares core CPI inflation with CPI and PCE index:

You can see that the blue line representing core CPI inflation index and the red line representing core PCE inflation index are a lot smoother than the purple CPI and lime PCE index line. Note also that the CPI-based measures are higher than PCE based measures of inflation.

by Obaidullah Jan, ACA, CFA and last modified on