Cyclical Unemployment

Cyclical unemployment refers to the increase in total unemployment that occurs when an economy is in recession. It is represented by difference between the unemployment rate and the natural rate of unemployment.

Unemployment rate is never zero, not even at the peak of economic booms. It is because some sources of unemployment such as the mismatch between available jobs and workers, exist during all phases of business cycle. The actual unemployment rate (ua) fluctuates around the natural rate i.e. it increases when the economy enters recession and decreases when it makes a recovery.

Actual rate of unemployment (ua) can be defined as the sum of natural rate of unemployment (un) and the rate of cyclical unemployment (uc):

ua = un + uc

The rate of unemployment that prevails during all phases of a business cycle is called the natural rate of unemployment (un). It changes in response to non-cyclical factors such as demographic changes, changes in minimum wage, etc.

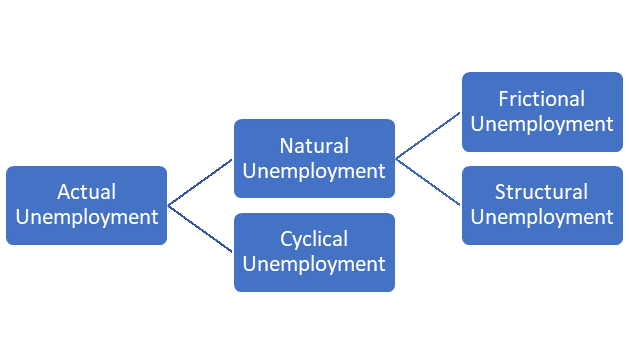

The rate of natural unemployment represents the combined effect of (a) frictional unemployment and (b) structural unemployment.

$$ \text{u} _ \text{n}=\text{u} _ \text{f}\ +\ \text{u} _ \text{s} $$

Frictional unemployment (uf) results from the time it takes in matching suitable candidates to jobs. Structural unemployment (us) occurs when at the prevailing wage there is a surplus of workers and the market is not able to reach equilibrium due to wage rigidity.

It follows that the actual unemployment rate is the sum of rate of frictional unemployment, rate of structural unemployment and rate of cyclical unemployment:

$$ \text{u} _ \text{a}=\text{u} _ \text{f}\ +\ \text{u} _ \text{s}\ +\ \text{u} _ \text{c} $$

The cyclical unemployment closely mimics the output gap i.e. the difference between actual gross domestic product (GDP) and potential GDP i.e. when the cyclical unemployment is high, output gap is high too and vice versa. This relationship is expressed by Okun’s law.

Cyclical unemployment also features in the Phillips curve which shows that decreases in cyclical unemployment causes demand-pull inflation. When the cyclical unemployment is low, more people are employed, there is more income is to be spent on a given amount of goods and hence inflation rises.

Example

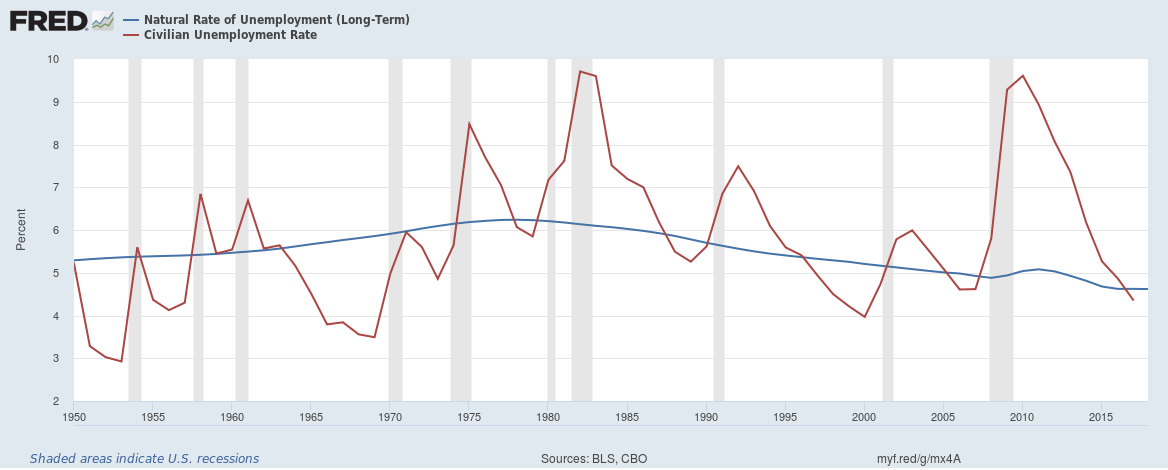

The following graph shows the relationship between actual unemployment rate and natural rate of unemployment:

FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/

It is clear from the graph above that the actual unemployment rate (represented by the red line) has oscillated around the natural rate of unemployment (blue line). During recessions (represented by the grey areas), the actual rate has shot up abruptly which represents a steep surge in cyclical unemployment. During recoveries, on the other hand, the actual unemployment rate has gravitated towards the natural rate. In some instances, the actual unemployment rate is even lower than the natural rate which tells that the cyclical unemployment is negative in that period.

by Obaidullah Jan, ACA, CFA and last modified on